Housing market ‘red flare’: Moody’s chief economist sees home price declines spreading

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Just weeks ago, Moody’s chief economist Mark Zandi was signaling cautious optimism. In a mid-May conversation with Gunnar Branson, CEO of the Association of Foreign Investors in Real Estate (AFIRE)—a global network of international investors focused on U.S. real estate—Zandi said the economy appeared resilient and that the additional housing market softening this spring looked more like “yellow flares” than anything more serious.

That caution has since escalated: Zandi is now issuing a “red flare.”

In a July 13 post on X, Zandi warned that home sales, homebuilding, and even house prices are set to slump unless mortgage rates fall materially from their current 7% range—something he believes is unlikely.

“The housing downturn to date has been mostly about the depressed existing home sales,” Zandi told ResiClub. “New home sales, housing completions, and house prices have held up well—that’s about to change.”

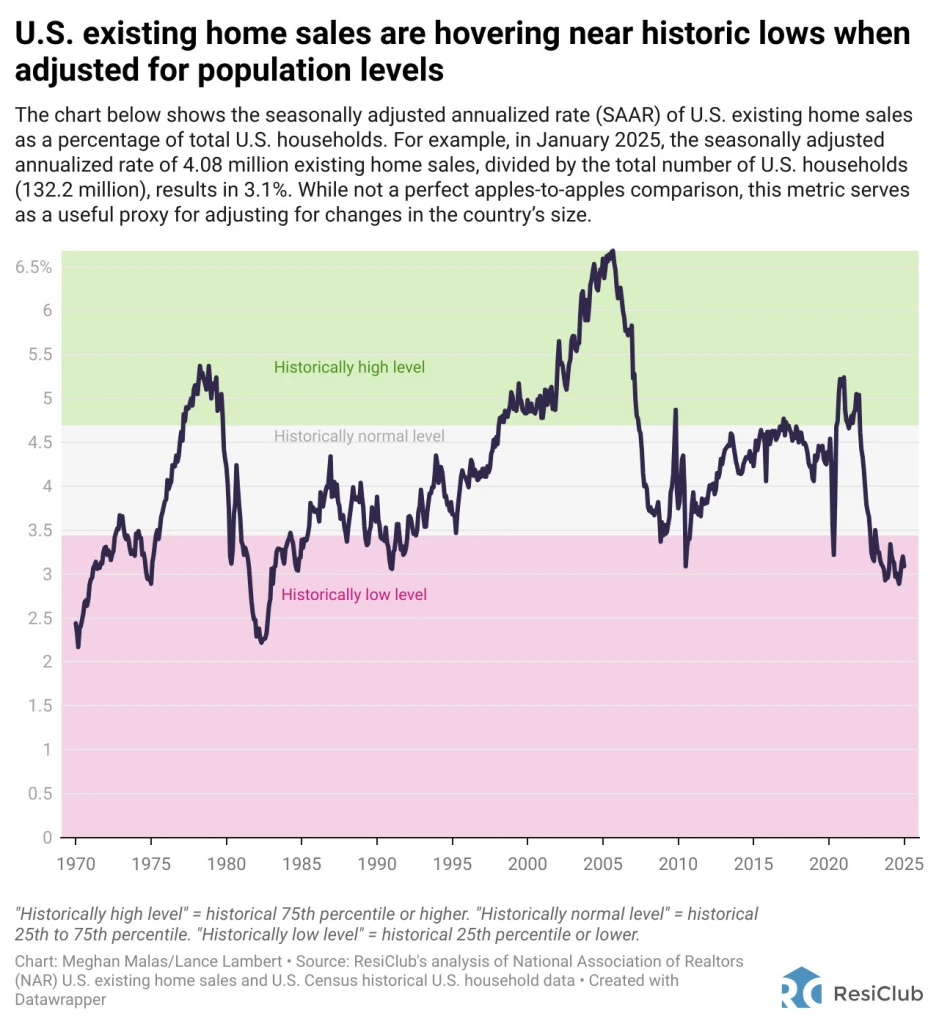

Existing home sales have been stuck at historic lows since the pandemic housing boom ended in mid-2022. Between early 2020 and 2022, soaring house prices and then soaring mortgage rate hikes rapidly deteriorated U.S. housing affordability.

Since then, the housing sector has been in a slump, with continued job losses and slashed commissions for mortgage brokers and agents as transaction volumes receded.

But now, the housing market could be headed for even more weakness.

One of the clearest tells, according to Zandi, is that builders are now postponing land deliveries—a move that typically precedes a drop in construction activity and could mean fewer starts and completions in the quarters ahead.

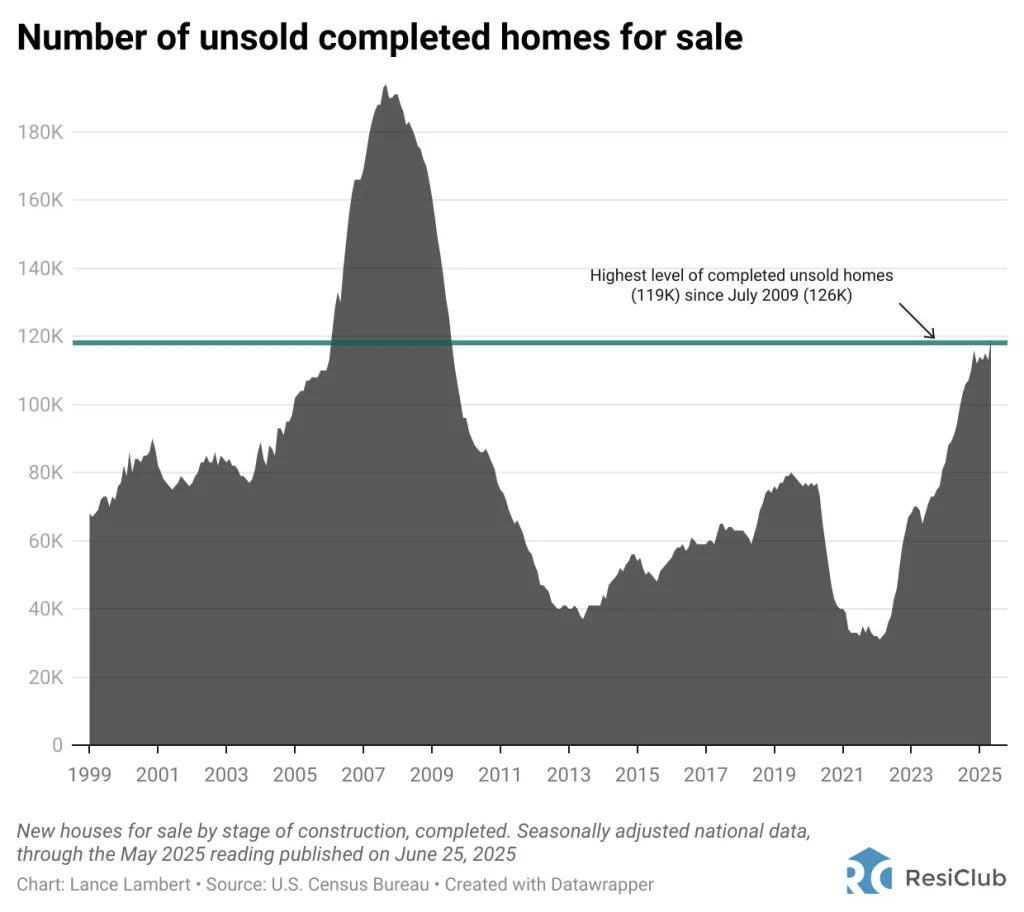

It’s not surprising that homebuilders are pulling back, given that unsold inventory just hit another 15-year high.

Click here for an interactive version of the chart below

According to an analysis of U.S. Census Bureau data by ResiClub, the number of unsold completed homes hit 119,000 in May 2025—the highest it’s been since July 2009, when it hit 126,000.

More home price declines are likely, especially in the South and West

Zandi told ResiClub that he expects national house prices to fall by a mid-single-digit percentage, from peak to trough, over the next 18 to 24 months, assuming mortgage rates remain near 7%.

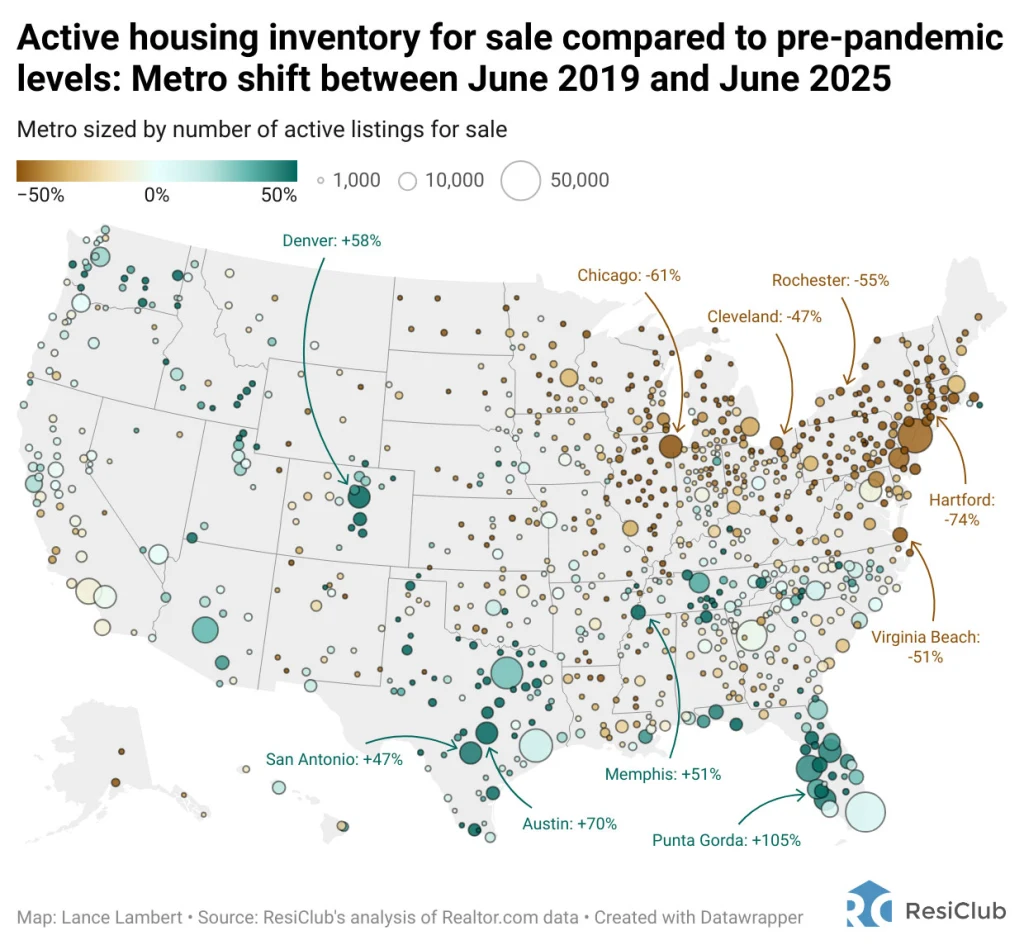

But not every region will be impacted equally.

“Prices will be weakest in the South and West, where affordability is lowest and there has been more construction,” he said.

These regions—many of which saw home prices stretch far beyond local income levels during the pandemic—are now seeing softening demand and rising inventory.

Unlike the Sun Belt, many Northeast and Midwest markets experienced less pandemic-era migration and limited new construction. With tighter inventory and fewer builder-driven price adjustments, home prices in these markets have remained more stable heading into spring 2025.

Builders in metro areas like Austin, Phoenix, and Tampa, Florida, have leaned on incentives—like mortgage rate buydowns—to keep home prices elevated and maintain sales. But as those incentives become less effective or too costly, some builders are starting to cut prices outright, putting pressure on both the new and resale markets.

Simply put, Zandi thinks the housing downturn is broadening. So far, the housing downturn since mid-2022 has mostly hit one side of the market: existing home sales—which remain at historically low levels due to lock-in and affordability barriers. But Zandi’s warning suggests the next phase of the downturn could cut deeper, dragging down home prices in some regional markets as well as construction activity.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0