The ESPN app has landed: ‘We can’t look at this launch as a movie opening’

On August 21, the self-described “leading multi-platform sports entertainment brand” began allowing consumers to subscribe directly through a service called . . . ESPN. Unlike ESPN+, which launched in 2018, the new streaming service provides access to the network’s full range of content and coverage.

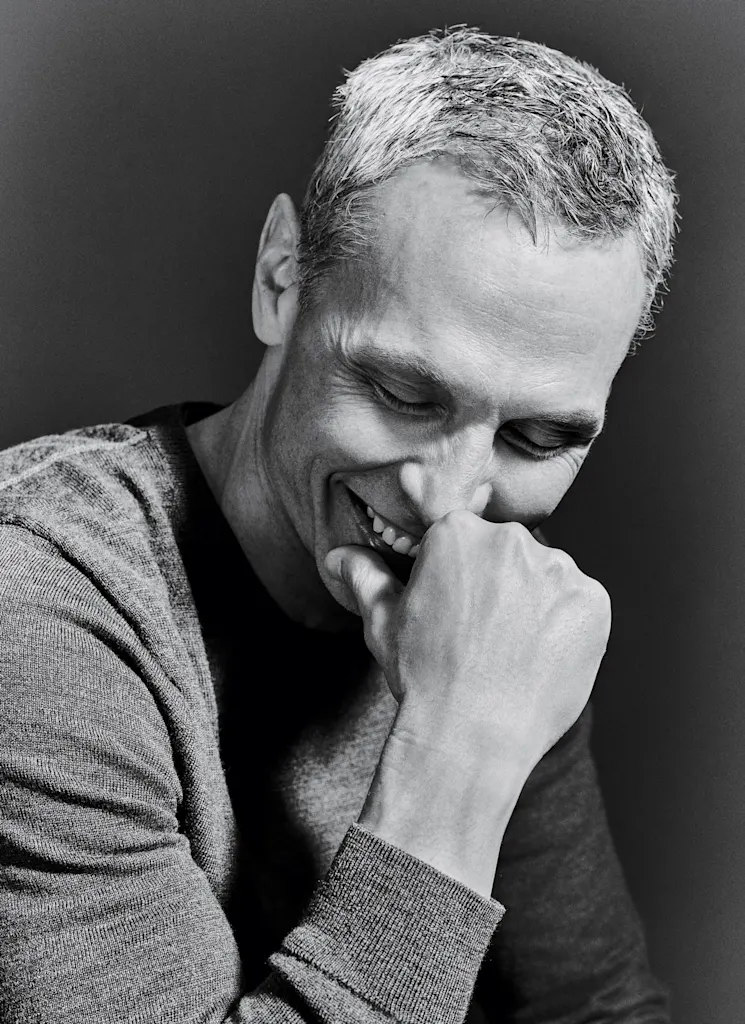

The various pricing and bundling subtleties would take too long to describe here, but the direct-to-consumer version of ESPN costs around $30 a month and is mainly targeted at “the 60 million-plus households that are not accessing ESPN in the traditional ways today,” says ESPN chairman James “Jimmy” Pitaro, a former lawyer who’s been running ESPN for more than seven years.

He will need those households, plus as many future cord-cutters as possible. Over the past decade, ESPN has lost more than 25 million cable subscribers (each worth about $10 a month in carriage fees the network collects from cable providers). And more are disappearing every day.

I recently sat down with Pitaro at his Westport, Connecticut, home, an airy place with a “Beatles bathroom” (the walls are covered with photos of the Fab Four), a basketball hoop in the driveway, and a mixed-breed rescue dog named Jeter. We spent the bulk of the interview talking about the DTC service but also covered his relationship with Disney CEO Bob Iger and the growing importance of gambling to ESPN’s business. A few weeks later, following news of ESPN’s big deal with the NFL, we had an email exchange about his vision of where the NFL Network and RedZone will fit into ESPN’s expanded portfolio.

This interview has been edited and condensed.

Your job is to make big bets that take years to plan. You’re doing long-term rights deals and building the product at a time when consumer behavior and technology are moving so quickly that it’s hard to predict the next year, much less the next decade. How do you manage that?

That question is incredibly relevant to ESPN today. We are navigating through some storms here, and the biggest is cord-cutting. My challenge has been protecting that traditional ecosystem—cable and satellite television—but also setting ourselves up for a direct-to-consumer future.

We launched ESPN+ in 2018, and over the past seven-plus years, we’ve been very strategic, very thoughtful, about how much we move over from traditional television to direct-to-consumer, how much we simulcast on both, and how much we acquire specifically for direct-to-consumer. We’ve also been very focused on the trends and where customers, especially younger people, are spending their time, right? And every week, every month, we see reports from our strategy team that have led us to this moment: our full direct-to-consumer launch.

We will make all of our channels available direct-to-consumer, not just that subset of content that we put up on ESPN+. But we will continue to run these parallel paths. If you’re happy with your traditional cable or satellite subscription, we’re going to be there for you. If you are currently on the sidelines, meaning you do not have a cable or satellite subscription and are therefore unable to access all of ESPN . . . we’re [now] going to be there for you as well.

What elements of your previous jobs at Yahoo and Disney are most relevant to the challenges you face at ESPN?

Well, I started as a lawyer. I was a litigator for many years in New York, and I learned a ton practicing law. Probably most important was my experience on the dealmaking side. At ESPN, I spend more than 50% of my time on dealmaking, on partnerships with the leagues, partnerships with the [college] conferences.

I had done a bunch of deals as a lawyer [for Yahoo] for the guy who was running Yahoo Media Group, and the job opened up to run Yahoo Sports, and they were looking for a dealmaking guy. I went from managing a very small team to managing a very large team, including hundreds and hundreds of engineers. I’m not an engineer, don’t know how to write code, but the challenge of taking on tech responsibility and immersing myself in tech was very helpful to me today as we think about going all in on direct-to-consumer.

Iger is a big sports fan. Has that helped you in your job?

We talk or text seven days a week, not just about business but also about our families, and yeah, we share our fandom and our passion for the Yankees and the Knicks. Bob happens to be a Green Bay Packers fan, so we do not share that. I’m a Giants and Rangers fan. But we speak daily about sports. We also have a relatively new CFO at Disney, Hugh Johnston, who’s a huge sports fan and knows a ton about the sports industry. I’m fortunate to be surrounded by colleagues who care deeply and a boss who cares deeply about what we’re doing at ESPN.

Let’s talk just a little bit about your leadership philosophy: Discuss, Debate, Decide, Align.

I don’t know if I can take credit for that, but I can tell you I have really embraced the idea of getting our executives together and presenting topics—some of which are quite polarizing, quite hairy—and debating. All of my direct reports know that they can challenge me. We try to decide as a team. I learned more from team sports than I did from undergrad and law school combined.

We meet as a leadership team every week, and it’s my job to create the agenda for the meeting and to try to tackle the most material issues. We’ll go around and we’ll debate, we’ll disagree, and then we decide as a team. And for the most part, we’re able to do that. There are times when we can’t, and then I’ll decide, and then the expectation is that we all align. Otherwise, it all kind of craters. It falls apart.

What’s an example of a debate that was particularly polarizing, where there was no obvious right answer?

The foundation of ESPN is live games. And because live games are so important, we spend a huge amount of time talking about what’s out there that we might want to go after, what we currently have and do we want to renew, extend, or do we want to exit. For example, with Major League Baseball, we had a contractual right to opt out [at the end of 2025]. And so we actually all decided together as a team that it made the most business sense to execute that, to opt out.

But there are other examples of rights—league rights, conference rights—that are either with us today or becoming available, where the team has not been united. But look, it’s very expensive. And there’s more competition today than there has ever been, and it is harder today to value these rights than it was when it was just linear television.

How do you look at the entrance of the streamers into live sports?

Well, first off, I think having someone like Netflix, Amazon, YouTube investing in growing leagues and growing sports is good for us. It’s a rising tide. What Amazon has done with Thursday Night Football is great for the NFL, and I’d argue it’s great for ESPN and the Walt Disney Company, because [having] more people, including younger people, watching Thursday Night Football means more people are going to watch Monday Night Football.

On the bad-news side, yeah, it’s more competitive there, and prices are going up because there are more interested parties. I can only give you my perspective on their priorities, but what I’ve seen, especially over the past year, is the same amount of discipline that we’ve demonstrated [in valuing rights]. They are modeling these rights out, and I don’t think that any of them are going to do a deal that puts them in the red. They’re only going to do something that is profitable for them.

Which is good for you.

Correct, correct. Of course.

Sports betting is a huge part of the sports business and sports media, and ESPN is no exception. What is your vision for the role of gambling in the future of the company?

My job is to provide clarity in terms of our mission and our business priorities. Our mission is to serve the sports fan anytime, anywhere. The sports fan today views sports betting—not every sports fan, but for the most part—as a part of the fan experience. And so we decided, as a leadership team at the Walt Disney Company several years ago, that we needed to be present.

So we took a step back and looked at the value of our brand. And we know that our brand conveys trust to the sports fan. We know that we are the place of record for sports fans. When something happens in sports, people turn to ESPN, and so there’s a great deal of responsibility there. But again, if you look at the sports fan experience today, if we’re going to deliver on our mission and we’re going to serve the sports fan responsibly, we needed to do more, and so we started to speak with several online sports books, and we ultimately decided to partner with Penn Entertainment. We did essentially a brand licensing deal to start. The book is now called ESPN Bet, and we’re looking at this as still being early days. Really the first inning here.

When we launch the enhanced ESPN app, you’re going to see significant betting integration. Now, it’s our responsibility to make sure that we’re doing this in a responsible way, and a lot of this will be driven by personalization. You’re going to see more betting integration if you are a sports bettor and if you have linked your ESPN account with your ESPN Bet account. We will, of course, have that information and be able to personalize the experience for you.

Do you believe there is tension here? People need to believe that these games have competitive integrity. News just broke [in late June] that former Detroit Pistons guard Malik Beasley is under investigation due to unusually heavy betting on his personal stats during some games in the 2023-2024 season. Do you worry about gambling undermining the public’s trust in the games, either due to a big 1919 World Series-type scandal or things like the Beasley news?

Look, obviously I’m aware of the incidents. I will tell you that my interpretation is that the system is working. We have been able to identify the problems.

Meaning the tech can spot irregular betting patterns that indicate corruption?

Yeah, exactly. I want to add: We’re investing in this space [for other reasons too]. Yes, it’s a part of the sports fan experience, especially for younger people today. But also, if you place a bet on a sport, you’re more likely to watch it, right? So sports betting is actually driving the business because it’s driving audience engagement, it’s driving ratings, it’s driving corresponding ad sales and sponsorship. So yes, there’s the sports betting side of it. We’re getting paid [$2 billion in cash and stock over 10 years] by Penn Entertainment to use our brand, but also, the more people bet on sports, the more engaged they are with our linear programming, our direct-to-consumer offering.

Now, I don’t want that to sound callous. We have to be responsible, and we need the technology. Penn has the technology, in terms of identifying problem bettors and cutting them off. We do public service announcements. We’re doing, I think, what we can to be responsible here.

Penn Entertainment’s market share is still very small, 2% to 3%, and it hasn’t really grown. DraftKings and FanDuel occupy the top slots, periodically trading positions as No.1 and No.2, with a combined market share of about 70%. Does that concern you? Are you disappointed that Penn hasn’t been able to carve out a larger share?

It’s the first inning. I said it before. We are very early. We need some time to launch this enhanced app with the full betting integration. I think we’ll be in a better position in a year’s time.

Talk to me a little bit about how you see the future of women’s sports, which has exploded in popularity in recent years.

Women’s sports is not a new priority at ESPN, and this long predates me. We’ve been investing in women’s sports for decades. The momentum today, with so many of our competitors embracing women’s sports—it’s great for the industry. We are going to continue to make these investments. We will continue to acquire rights.

We recently closed our WNBA deal that starts next season. It’s a new 11-year deal. We reached an agreement with the NWSL [National Women’s Soccer League], and we would love to talk to the NWSL about expanding that partnership. We are massively invested in women’s college sports.

It’s not just the games, it’s the studio programming. We have a new [women-led studio] show called Vibe Check. We’re investing in female talent, investing in a fantasy game for the WNBA, investing in covering women’s sports on social. Identifying more and better time slots on ABC and ESPN for women’s sports has been a priority, and you’ve seen us continue to lean in there.

These investments are a huge morale boost. Our employees love working on women’s sports, and take so much pride in advancing these leagues and advancing these games.

I would be remiss if I didn’t ask if you will support the presidential campaign of Stephen A. Smith.

I actually have not talked to Stephen A. Smith about any of that. We just got our deal done with Stephen, and I’m thrilled with it. He is in a very good place himself with the deal.

There is no harder working person in the sports media business than Stephen. I’ve never once called him and asked him to do something where he hasn’t immediately said yes. We are very fortunate to have him on our side. We know that people tune in to First Take specifically for Stephen. That matters in terms of our desire to grow our audience, and it matters in terms of our ability to secure advertisers and secure sponsorship. Stephen is a huge part of our future.

You’ve got a few years here, but I’m curious if you’ve had any early thoughts on the 50th anniversary, in 2029, and what you might do to honor that occasion.

I was fortunate to be here for the 40th anniversary, and we had many of the legends at ESPN, some of whom don’t work at ESPN anymore, like Mike Tirico and Robin Roberts, come back to Bristol, and sat on a stage and talked about their experience. And I’ve got to tell you, as a sports fan, I got chills sitting there listening to them. It’s still one of my proudest moments at ESPN.

Fast-forward to our 50-year anniversary, and I would like to do something very similar. It was such a huge success, and I just remember looking out into the audience and seeing hundreds of ESPN employees smiling and taking so much pride in what we’ve accomplished together and hearing firsthand from these legends. This time maybe we’ll broadcast it. It would probably warrant air time.

You mentioned that you and your leadership team spend a lot of time debating sports rights. How would you characterize the level of agreement or disagreement around the NFL deal involving NFL Network and RedZone?

Everyone was on board with the idea of being able to include the NFL Network and all of the games and other NFL content in ESPN direct-to-consumer, as it will give fans another way to engage with the network and, at the same time, fuel our overall business. Bottom line, we’re making more content from the most popular league in America easier for fans to access.

The NFL will own 10% of ESPN. ESPN covers the NFL intensively, and covering ownership presents ethical issues. Does this concern you?

We’re not concerned. The NFL has never asked us to change our approach to coverage—nor would we. Objective and fair reporting is core to our DNA. That applies not just to the NFL but to all our league partners. They understand that, and it’s not going to change.

Your name comes up often as a potential successor to Iger as CEO of Disney. You’ve downplayed it, saying—I’m paraphrasing—that you’re happy at ESPN. Have you officially told the board that you’re not interested?

What I have said is I am in my dream job. I’m a huge sports fan. I spent years competing as an athlete. Then I ran Yahoo Sports. I spent years competing against ESPN. Then I spent years at the Disney leadership table, reporting directly to Bob Iger, getting my annual review, and always finishing that conversation with, “Hey, maybe someday I’ll end up at ESPN,” or Bob saying, “Maybe someday you’ll end up at ESPN.”

We’ve worked very hard over the past few years, building out this direct-to-consumer strategy, this parallel-path strategy. One of the things that I’ve said to our leadership team at ESPN and to the team at Disney is we can’t look at this launch as a movie opening. The product is going to get better regularly, and so we’re not going to judge ourselves based on either the number of people that subscribe to ESPN over the first weekend or the first couple of weeks, or even the first couple of months. And we’re not going to evaluate the product that way either.

That’s a long way of saying that I am incredibly motivated by my current job. I love my job, and this is the job that I’ve always wanted for as long as I can remember.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0