Unsold completed new-build inventory is so high this $34B homebuilder is turning to investors

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

As public homebuilders work to clear rising levels of unsold completed inventory in softer Sun Belt housing markets, they’re not only upping their incentive spend for homebuyers—they’re also stepping up efforts to attract the housing market’s biggest investor group: mom-and-pop landlords.

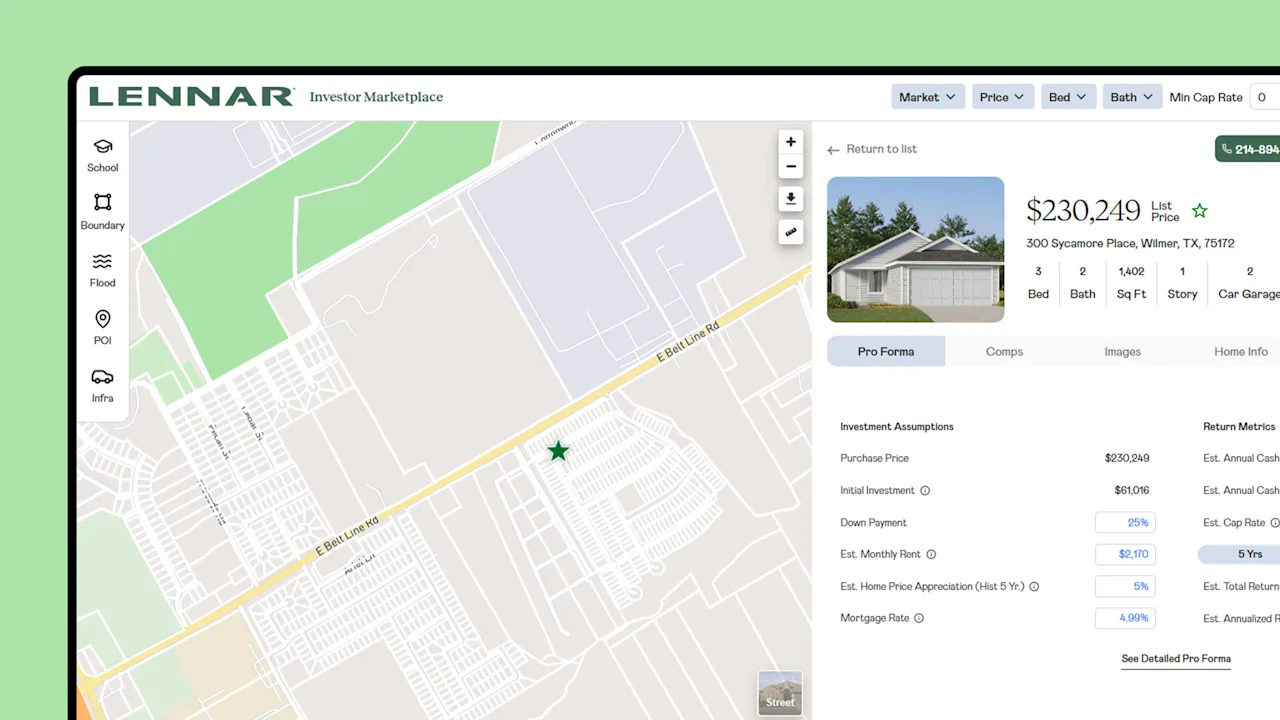

Look no further than this week Lennar launching the Lennar Investor Marketplace. The homebuilder—which has a $34 billion market capitalization—says the portal allows investors “at any level to browse curated new homes and make informed, data-driven decisions.”

After creating an account, investors can view Lennar homes for sale nationwide. For the Florida build below in Manatee County, the site displays Lennar’s current offer (a 7/6 ARM at a 4.99% interest rate) along with the projected rental yield based on estimated rent and cash flow.

Lennar’s new investor site automatically inputs several figures (including expected monthly rent, down payment, and home price appreciation) to calculate the yield/return for the given home. It might be wise to take those assumptions—in particular for future home price appreciation—with a grain of salt.

The good news is that the site also allows investors to adjust those figures to see how those assumptions would shift the return/yield.

The fact that Lennar just built and launched an investor marketplace comes as unsold completed single-family new construction has climbed to a 15-year high:

June 2018 —> 62,000

June 2019 —> 79,000

June 2020 —> 66,000

June 2021 —> 34,000

June 2022 —> 38,000

June 2023 —> 69,000

June 2024 —> 99,000

June 2025 —> 119,000

The June 2025 figure (119,000 unsold completed new homes) published last week is the highest level since July 2009 (126,000).

While there has been an increase in slack in the new construction market, it isn’t evenly distributed.

The greatest softness—and build up in both unsold resale inventory for sale and unsold completed new homes for sale—can be found in pockets of the Mountain West, Southwest, and Southeast. In particular, housing markets like Tampa, Austin, San Antonio, Nashville, Dallas, Cape Coral, and Punta Gorda.

Among homebuilders trying to prevent a bigger pullback in sales amid this softer housing market environment, Lennar is the most aggressive builder on the incentive front.

Last quarter, Lennar spent the equivalent of 13.3% of the final sales price on sales incentives, such as rate buydowns. For a $400,000 home, that translates to $53,200 in incentives. According to John Burns Research and Consulting [see their historical chart here], that’s the highest incentive level Lennar has offered since 2009—and it’s significantly higher than Lennar’s cycle low in Q2 2022, when it spent 1.5% of the final sales price on sales incentives.

Big picture: There’s greater slack in the new construction market now than a few years ago, giving buyers and investors some leverage in certain markets to negotiate better deals with homebuilders.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0