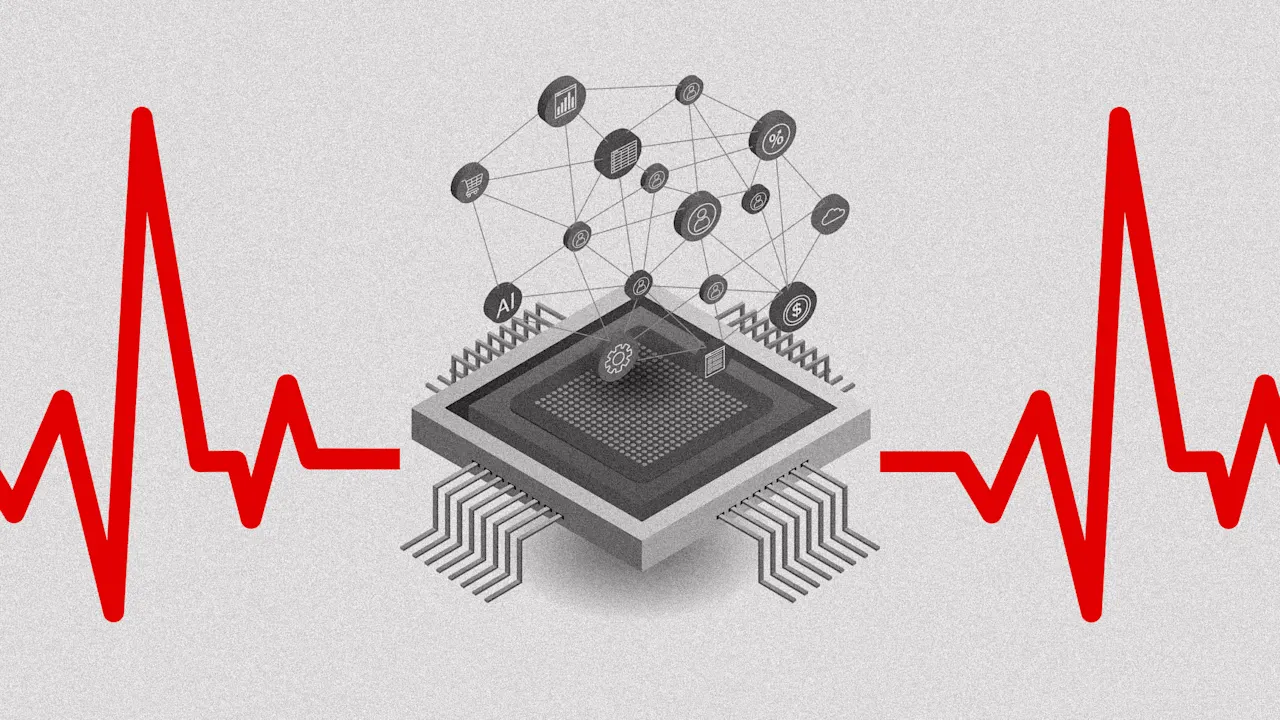

Why is GDRX stock up 30% today? GoodRx strikes deal to sell Ozempic and Wegovy after Novo Nordisk’s breakup with Hims

Share prices of GoodRx (NASDAQ: GDRX), the American healthcare company and telemedicine service, are currently soaring after the company announced that it will partner with Novo Nordisk to offer the lowest-ever out-of-pocket prices for Ozempic and Wegovy.

According to a press release posted early on August 18, GoodRx has struck a deal with the pharmaceutical giant Novo Nordisk to sell its popular semaglutide medications, Ozempic and Wegovy, for just $499 per month to “eligible self-paying customers.”

GoodRx doesn’t sell or dispense any drugs itself, but rather provides savings and coupons that can be applied in pharmacies. Its exclusive Ozempic and Wegovy offerings, available starting today, are the lowest out-of-pocket costs for the medications available on the market.

The news comes just weeks after Novo Nordisk cut ties with the telehealth company Hims & Hers Health (NYSE: HIMS) over claims that Hims & Hers was selling “knockoff” versions of Wegovy. It’s a dispute that reflects a broader discussion around whether compounded semaglutide drugs—or non-FDA approved versions of brand-name medicines—are a violation of intellectual property laws.

As of this writing, GoodRx’s stock is up by more than 30% since market close. Here’s what to know about Novo Nordisk’s latest partnership and its ongoing legal battles against compounded GLP-1s.

GoodRx’s collaboration with Novo Nordisk

In the last year alone, GoodRx reports that nearly 17 million people visited the site searching for information and savings on GLP-1 medications—a 22% increase from the previous year.

“Demand for GLP-1 medications is at an all-time high, but too many Americans still face barriers accessing them,” Wendy Barnes, GoodRX president and CEO, said in the press release. “By partnering with Novo Nordisk, we’re taking a significant step forward in making these innovative brand-name treatments more accessible for millions of people who need them.”

In the past, a spokesperson told Fast Company, GoodRx has worked with both Novo Nordisk and its competitor Eli Lilly to offer commercially insured patients manufacturer savings cards on GLP-1s. The company has also offered savings on other types of weight loss/diabetes treatments, including Contrave, Dexcom G7, Lantus, and Qsymia.

However, this is the first time that GoodRx has offered a cash price for a GLP-1. The $499 monthly self-pay cost will be available at more than 70,000 retail locations nationwide.

Novo Nordisk’s current legal battles over compounded GLP-1s

So far, investors’ response to GoodRx’s new collaboration has been overwhelmingly positive. It stands in sharp contrast to Hims & Hers’ recent breakup with Novo Nordisk, which caused the telehealth company’s share prices to plummet in late June.

Hims & Hers and Novo Nordisk parted ways over Hims & Hers’ offering of compounded versions of Wegovy. Back in 2022, the Food and Drug Administration (FDA) declared a shortage of GLP-1 medications including Ozempic and Wegovy. Under this shortage notice, pharmacies were permitted to make compounded versions of the brand-name drugs using their active ingredient, semaglutide, and sell them at a lower cost. However, Hims & Hers has continued to sell its compounded version of Wegovy long after the FDA lifted the shortage back in February.

Now, Novo Nordisk is arguing that these compounded drugs are both a violation of its intellectual property and potentially dangerous to patients, due to their lack of FDA approval. Early this month, Novo Nordisk announced 14 new lawsuits against small pharmacies, telehealth providers, and weight-loss clinics over compounded versions of Ozempic and Wegovy—bringing its total cases filed on the matter up to more than 130 in 40 states.

Experts say that federal compounding laws are just vague enough to allow for various interpretations, meaning that Novo Nordisk’s current legal challenges could shape the way courts interpret those boundaries in the future.

In a statement to Yahoo Finance, Barnes offered a clear look into GoodRx’s stance on compounded drugs: “There’s no question we could have tried to do something sooner from a compounded alternative pathway, but we have been very clear in our belief that it needed to be FDA-approved, lawfully approved. It just wasn’t a pathway that we were going to support,” she said.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0