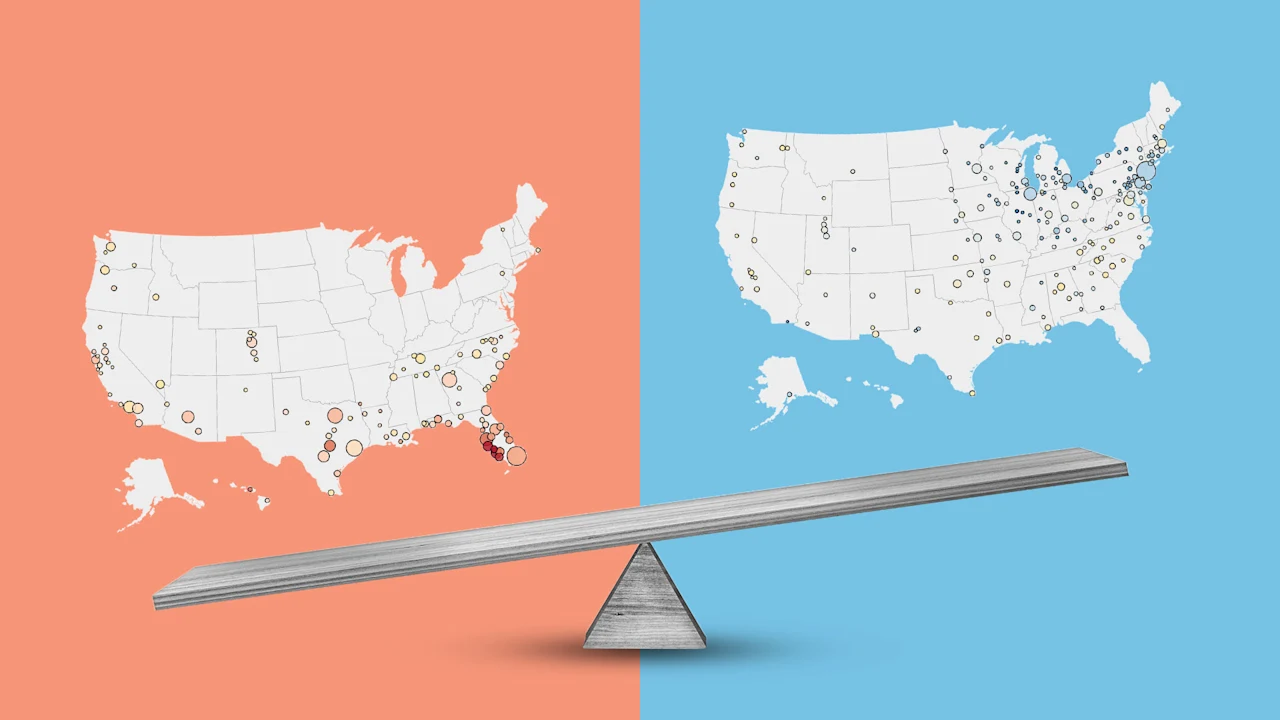

Housing market split: Home prices falling in 105 metros, rising in 195

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

National home prices rose 0.2% year over year from July 2024 to July 2025, according to the Zillow Home Value Index reading published August 18—a decelerated rate from the +2.8% year-over-year rate from July 2023 to July 2024.

And more metro-area housing markets are seeing declines:

—> 31 of the nation’s 300 largest housing markets (10% of markets) had a falling year-over-year reading from January 2024 to January 2025.

—> 42 of the nation’s 300 largest housing markets (14%) had a falling year-over-year reading from February 2024 to February 2025.

—> 60 of the nation’s 300 largest housing markets (20%) had a falling year-over-year reading from March 2024 to March 2025.

—> 80 of the nation’s 300 largest housing markets (27%) had a falling year-over-year reading from April 2024 to April 2025.

—> 96 of the nation’s 300 largest housing markets (32%) had a falling year-over-year reading from May 2024 to May 2025.

—> 110 of the nation’s 300 largest housing markets (36%) had a falling year-over-year reading from June 2024 to June 2025.

—> 105 of the nation’s 300 largest housing markets (35%) had a falling year-over-year reading from July 2024 to July 2025.

All year, more housing markets have slipped into year-over-year price declines as the supply-demand balance gradually tilts toward buyers in today’s affordability-constrained, post-boom environment. But this month, that list of declining markets actually got a little shorter.

Home prices are still climbing in many regions where active inventory remains well below pre-pandemic 2019 levels, such as pockets of the Northeast and Midwest. In contrast, some pockets in states like Arizona, Texas, Florida, Colorado, and Louisiana—where active inventory exceeds pre-pandemic 2019 levels—are seeing modest home price corrections.

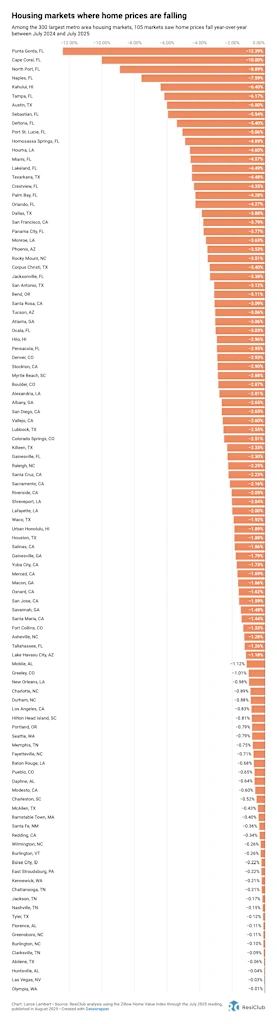

Year-over-year home value declines, using the Zillow Home Value Index, are evident in major metros such as Tampa (-6.2%); Austin (-6.0%); Miami (-4.6%); Orlando (-4.3%); Dallas (-3.9%); San Francisco (-3.8%); Phoenix (-3.5%); Jacksonville, Florida (-3.4%); San Antonio (-3.1%); Atlanta (-3.1%); Denver (-2.9%); San Diego (-2.7%); Raleigh, North Carolina (-2.3%); Sacramento (-2.2%); Riverside, California (-2.1%); Houston (-1.9%); San Jose (-1.6%); New Orleans (-1.0%); Charlotte, North Carolina (-0.9%); Los Angeles (-0.8%); Portland, Oregon (-0.8%); Seattle (-0.8%); Memphis (-0.8%); Nashville (-0.2%); and Las Vegas (-0.0%).

Click here for an interactive version of the chart below.

Many of the housing markets seeing the most softness, where homebuyers have gained the most leverage, are primarily located in Sunbelt regions, particularly the Gulf Coast and Mountain West. Many of these areas saw major price surges during the Pandemic Housing Boom, with home price growth outpacing local income levels. As pandemic-driven domestic migration slowed and mortgage rates rose, markets like Tampa and Austin faced challenges, relying on local income levels to support frothy home prices.

This softening trend is further compounded by an abundance of new home supply in the Sunbelt. Builders are often willing to lower prices or offer affordability incentives to maintain sales, which also has a cooling effect on the resale market. Some buyers, who previously would have considered existing homes, are now opting for new homes with more favorable homebuilder deals.

Given the shift in active housing inventory and months of supply, this softening and regional variation should not surprise ResiClub PRO members—we’ve been closely documenting it. (ResiClub PRO members can view our latest analysis of home prices across 800-plus metros and more than 3,000 counties here.)

Of course, while 105 of the nation’s 300 largest metro-area housing markets are seeing home price declines, another 195 are still seeing year-over-year home price increases.

Where are home prices still up on a year-over-year basis? See the map below:

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0