2025 Advisory Report Urges Congress and IRS to Boost Electronic Tax Solutions

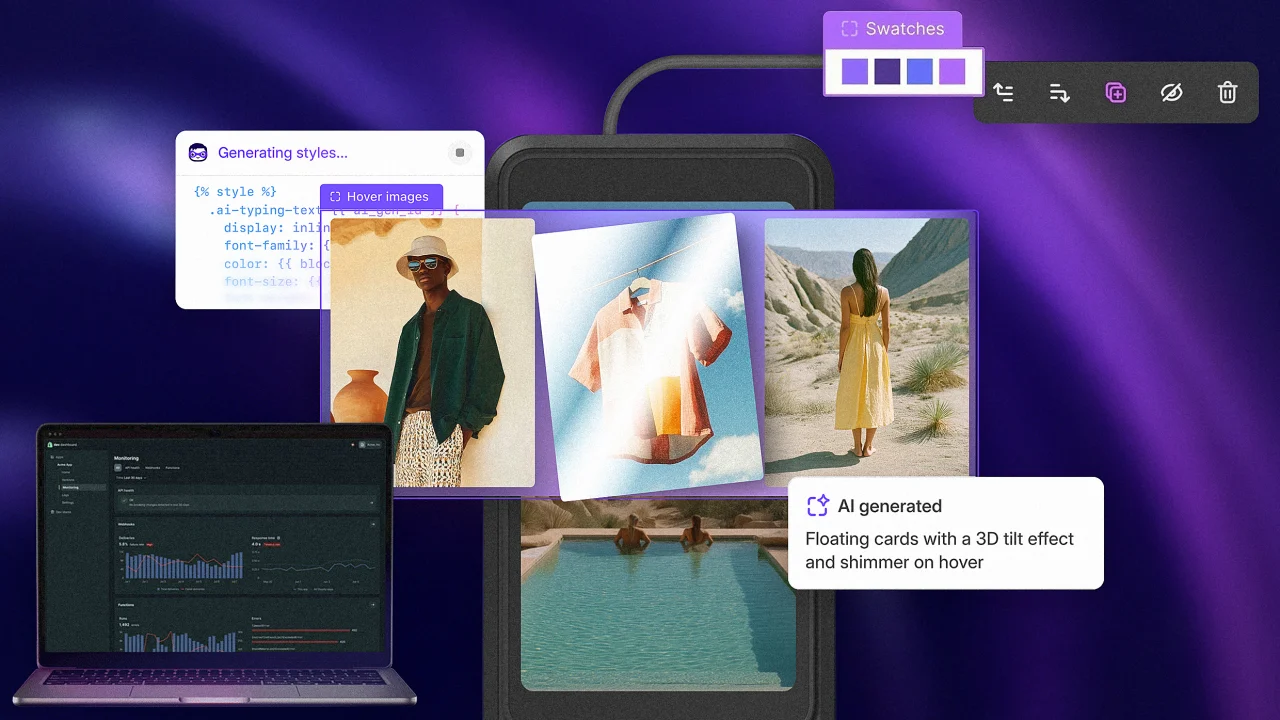

The landscape of tax administration is evolving, and small business owners need to pay attention. The Internal Revenue Service’s Electronic Tax Administration Advisory Committee (ETAAC) recently issued its 2025 annual report, featuring 14 recommendations designed to enhance security, streamline processes, and improve taxpayer services. These changes could directly impact how small businesses file taxes, interact with the IRS, and manage financial reporting.

Among the key recommendations to the IRS, the call for updated tax return forms stands out for its potential to enhance security measures against fraud and identity theft. IRS Commissioner Billy Long emphasized the importance of increasing digital interactions, noting, “Increasing digital transactions is one of the Internal Revenue Service’s key goals.” For small businesses that often operate with limited resources, this transition to digital could save time and mitigate the risk of errors that often come with manual processes.

The report also encourages the IRS to review and revise the list of Modernized e-File (MeF) reject codes and explanations, which can often cause confusion for filers. By ensuring these codes are clearer, the IRS aims to help small business owners avoid unnecessary complications when submitting their returns. Simplified communication around these processes can significantly reduce the stress and time burden on small businesses during tax season.

The committee’s recommendations extend to encouraging better information sharing between the IRS, state agencies, and industry partners. This could lead to more cohesive regulatory environments and less bureaucratic red tape for small business owners. For instance, if the IRS collaborates closely with state tax authority providers, it might streamline approval processes for state-related business tax matters, ultimately enhancing operational efficiencies.

Among its recommendations to Congress, ETAAC is advocating for tax simplification during the formulation of tax policy. Small business owners often find themselves buried under complex tax regulations, so any moves toward simplification could reduce compliance costs and enhance overall productivity. Additionally, if Congress grants the IRS the authority to regulate non-credentialed tax return preparers, it could increase standards across the industry—protecting small business owners from potential exploitation or incompetence in tax preparation services.

However, there are practical challenges in implementing these recommendations. The call for predictable funding for the IRS is crucial, as consistent resources will dictate the agency’s ability to effectively implement these enhancements. Small businesses should be aware that any funding shortfalls could delay progress on digital transformation and other recommendations impacting service delivery.

Furthermore, while increasing digital capabilities offers numerous benefits, it may also create barriers for small business owners who aren’t technologically savvy. Transitioning to a primarily digital system might require training and investment in technology that smaller operations might not readily afford.

ETAAC’s focus on technology modernization further indicates the necessity for small business owners to stay ahead of the curve. Adapting to new systems may require time and, in some cases, external assistance, but this adaptation could ultimately lead to more streamlined reporting and compliance processes.

In a nutshell, the recommendations from the ETAAC present a double-edged sword for small business owners. While they promise greater security, efficiency, and support from the IRS, there’s also the potential for initial hurdles in terms of adaption and the need for ongoing training.

Overall, the report serves as a reminder for small business owners to remain vigilant and proactive regarding changes in tax legislation and administration. Keeping an eye on these developments could better position small businesses to take advantage of new systems and processes, ultimately leading to smoother tax seasons ahead.

For more detailed insights and to access the full report, visit the original release at IRS ETAAC Report 2025.

Image Via Envato

This article, "2025 Advisory Report Urges Congress and IRS to Boost Electronic Tax Solutions" was first published on Small Business Trends

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0