Balancing Your Credibility Bank: Strategies for Building Trust Online

Key Takeaways

- Credibility as a Cornerstone: Credibility is essential for success, impacting customer trust, retention, and the overall reputation of your business.

- Understanding Your Credibility Bank: Your credibility bank symbolizes the trust and reliability you build with customers; deposits are made through positive actions, while withdrawals occur from unmet expectations.

- Strategies for Building Credibility: Focus on authenticity, transparency, and effective communication to enhance your credibility bank, ensuring alignment between your commitments and actions.

- Managing Expectations: Clearly define deliverables and manage customer expectations to foster trust and maintain a positive balance in your credibility bank.

- The Importance of Feedback: Actively seeking and utilizing constructive feedback is crucial for continuous improvement and enhances customer satisfaction and loyalty.

- Long-Term Focus: Regular assessment of your practices and consistent efforts to maintain credibility can significantly contribute to the sustainable growth of your small business.

In today’s fast-paced digital world, your credibility can make or break your success. Just like a bank account, your credibility bank needs careful management to thrive. Whether you’re a business owner, a freelancer, or an influencer, understanding how to balance your credibility is crucial for building trust and fostering lasting relationships.

You may wonder how to maintain that balance. It’s all about making consistent deposits through transparency, authenticity, and expertise while avoiding withdrawals caused by miscommunication or dishonesty. By mastering the art of credibility management, you’ll not only enhance your reputation but also open doors to new opportunities. Let’s explore how to keep your credibility bank thriving and ensure you’re always in the black.

Understanding Credibility

Credibility plays a vital role in your success as a small business owner. It establishes trust, influences customer decisions, and shapes the overall reputation of your brand.

Definition of Credibility

Credibility is the quality of being trusted and believed in. For small businesses, credibility often stems from reliable service, transparency, and authenticity. Customers evaluate your credibility through their experiences, reviews, and interactions with your brand. A solid track record of meeting expectations fosters loyalty and encourages repeat business.

Importance of Credibility in Various Fields

Credibility is crucial across diverse fields for several reasons:

- Small Business Success: Trust encourages customers to choose your products or services over competitors. Credibility boosts customer retention and satisfaction, leading to higher profit margins.

- Entrepreneurship: Startups thrive on credibility. Investors, such as angel investors and venture capitalists, seek credible businesses when considering funding opportunities. A credible business plan increases the likelihood of securing capital.

- Marketing and Branding: Your marketing efforts hinge on your credibility. Authentic branding strategies foster stronger connections with your target audience, enhancing customer acquisition and retention.

- Networking: Building a reputation for credibility opens doors to partnerships and collaborations. You gain access to invaluable networks that can elevate your business and facilitate growth strategies.

- Legal Considerations: Establishing a credible legal structure, such as an LLC or corporation, communicates professionalism. This enhances customer confidence, particularly when discussing matters like intellectual property or legal advice.

Focusing on building and maintaining your credibility can significantly impact your small business’s growth and sustainability.

The Concept of Your Credibility Bank

Your credibility bank is a metaphorical account where you store and manage the trust and reliability you build as a small business owner. This concept is vital as it reflects how the public perceives your commitment to integrity and transparency within your business operations.

What is a Credibility Bank?

A credibility bank represents the trust customers place in your business. It encompasses your reputation, reinforced by your actions and decisions. When you communicate openly, provide quality customer service, and deliver on your promises, you make deposits into your credibility bank. Conversely, failure to meet expectations or miscommunication leads to withdrawals. Maintaining a positive balance in your credibility bank is essential for long-term success, influencing customer acquisition and fostering repeat business.

How Credibility Accumulates and Depletes

Credibility accumulates through consistent adherence to your stated business goals, such as delivering quality products or providing exceptional service. For instance, if you maintain transparent pricing, engage in authentic marketing, and respond effectively to customer inquiries, your credibility bank grows.

Credibility depletes when trust is compromised. Instances such as negative customer feedback, unfulfilled promises, or lack of engagement can damage your reputation. For example, poor handling of a customer complaint can lead to a withdrawal from your credibility bank, affecting your sales and overall business viability.

To ensure credibility remains high, regularly assess your business practices and engage in sound marketing strategies, such as social media and content marketing, to build your brand’s image. By focusing on transparency and reliability, you can enhance your credibility bank, and ultimately drive growth for your small business.

Strategies for Balancing Your Credibility Bank

Building and maintaining your credibility bank involves several key strategies that foster trust and reliability in your small business.

Building Credibility Through Authenticity

Building credibility starts with authenticity. Your actions must align with your spoken commitments. If you promise timely deliveries, follow through. Consistently do what you say by meeting deadlines and fulfilling obligations. This practice enhances deposits in your credibility bank and helps you avoid withdrawals from unmet expectations. For instance, maintain transparency about your capabilities and limitations, ensuring your target audience feels secure in their interactions with your business.

Maintaining Transparency in Communication

Maintaining transparency in communication bolsters your credibility. Clear, concise messaging creates an open dialogue with your customers and stakeholders. Use digital marketing strategies to keep your website and social media platforms updated with accurate information. When communicating your business goals, ensure clarity regarding your services, pricing, and timelines. Transparency minimizes misunderstandings and strengthens relationships with customers, leading to long-term loyalty.

Managing Expectations and Deliverables

Managing expectations effectively contributes significantly to your credibility. Define deliverables clearly from the outset. Communicate openly about what clients can anticipate regarding timelines, quality, and outcomes. By establishing these parameters early, your small business can better navigate challenges and provide ongoing customer service that builds trust. Should expectations shift, promptly revise agreements to reflect new circumstances and keep all parties informed, thus reinforcing your credibility.

The Role of Feedback in Credibility Management

Feedback plays a vital role in managing your credibility effectively. For small businesses, understanding and responding to feedback can enhance trust and strengthen relationships with customers.

Importance of Constructive Feedback

Constructive feedback offers valuable insights into customer satisfaction and experiences. It reflects how well your business meets expectations and identifies areas for improvement. Listening to feedback fosters a culture of open communication, enabling you to adjust your strategies and services. Customers appreciate transparency and responsiveness, which enhance your credibility. Regularly reviewing feedback demonstrates your commitment to continuous improvement and customer-centric practices.

Utilizing Feedback for Improvement

Utilizing feedback effectively drives growth and innovation in your business. Analyzing customer reviews and testimonials helps you assess the impact of your products and services on your target audience. Implement feedback loops to gather insights through surveys or social media interactions. By addressing concerns or suggestions promptly, you reinforce customer trust and loyalty. Integrating feedback into your business plan aligns your offerings with market demands, fueling your overall growth strategy and ensuring sustainable success.

Conclusion

Balancing your credibility bank is essential for long-term success. By making consistent deposits through authenticity and transparency, you can build a solid foundation of trust with your audience. Remember that each interaction shapes public perception, so prioritize effective communication and deliver on your promises.

As you navigate challenges, keep an eye on your credibility balance. Regularly seek feedback and adjust your practices to align with customer expectations. This proactive approach not only enhances your reputation but also fosters loyalty and repeat business. Ultimately, a well-managed credibility bank opens doors to new opportunities and sustainable growth. Stay committed to maintaining that balance and watch your business thrive.

Frequently Asked Questions

What is the main focus of the article?

The article emphasizes the importance of managing credibility in the digital landscape. It compares credibility to a bank account that needs careful attention, highlighting its significance for business owners, freelancers, and influencers in building trust and fostering relationships.

Why is credibility important for small businesses?

Credibility is crucial for small businesses as it helps establish trust with customers, influences their purchasing decisions, and shapes the brand’s reputation. A solid track record of credibility fosters customer loyalty and encourages repeat business.

How can businesses make deposits into their credibility bank?

Businesses can make deposits by maintaining transparency, demonstrating authenticity, providing quality customer service, and fulfilling promises. These actions help build trust and reliability in the eyes of customers.

What can cause withdrawals from a credibility bank?

Withdrawals happen due to miscommunication, unmet expectations, or dishonesty. Negative feedback and unfulfilled promises can deplete a business’s credibility, damaging relationships with customers.

How often should businesses assess their credibility?

Regular assessments of business practices are recommended to maintain a high credibility balance. This includes evaluating communication strategies, customer feedback, and overall service quality to ensure trust remains intact.

What role does feedback play in managing credibility?

Feedback is vital in understanding customer satisfaction and experiences. It helps businesses identify areas for improvement and demonstrates their commitment to continuous growth, reinforcing trust and loyalty among customers.

How can businesses effectively use feedback for growth?

Businesses can implement feedback loops, such as surveys and social media interactions, to gather insights from customers. Addressing concerns promptly helps improve offerings, aligns services with market demands, and maintains credibility.

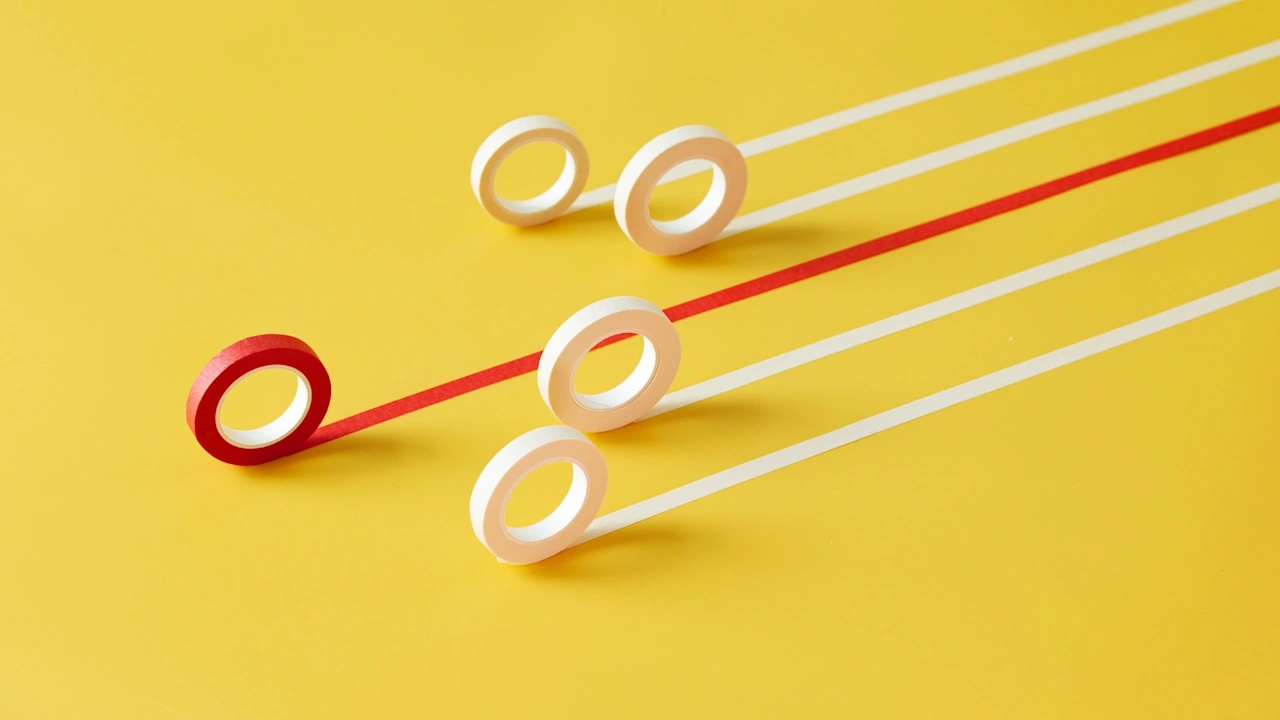

Image Via Envato

This article, "Balancing Your Credibility Bank: Strategies for Building Trust Online" was first published on Small Business Trends

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpeg?width=1200&auto=webp&trim=0,100,0,100#)

![Big Brother Recap: Rachel’s HOH Sends [Spoiler] Packing](https://tvline.com/wp-content/uploads/2025/08/big-brother-live-eviction-week-6.png?#)