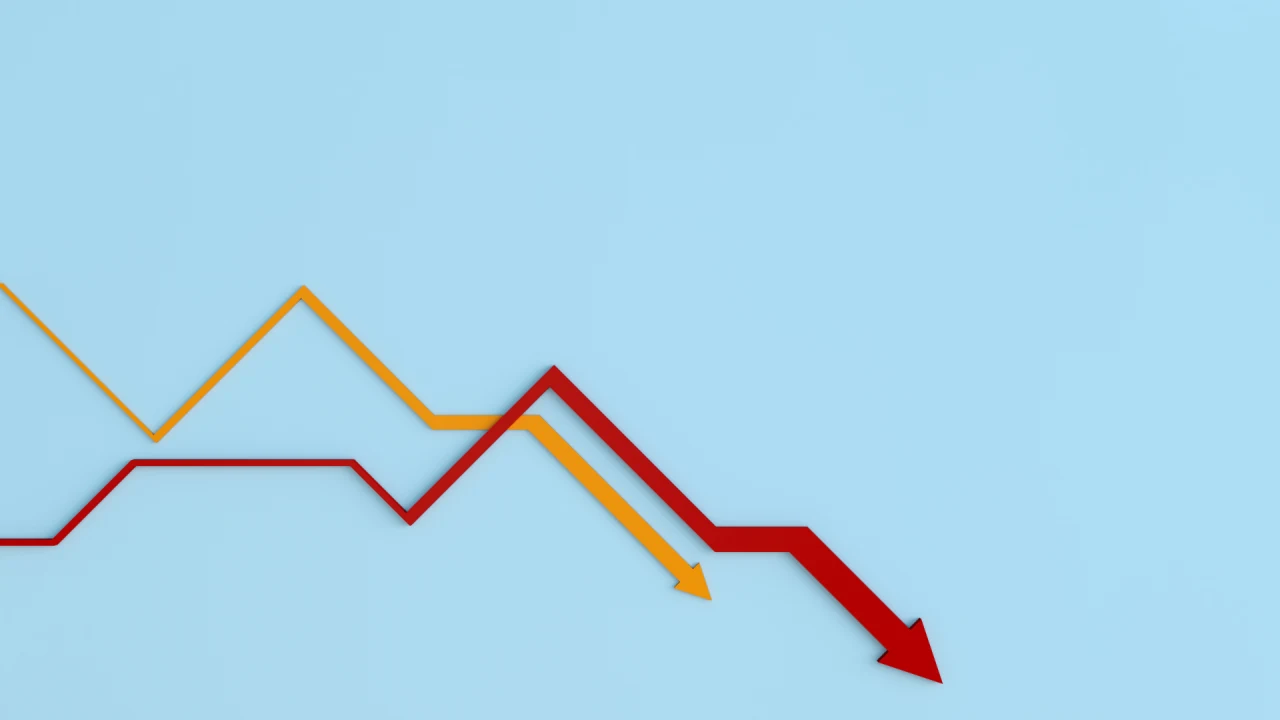

Is retirement legislation setting small businesses up to fail?

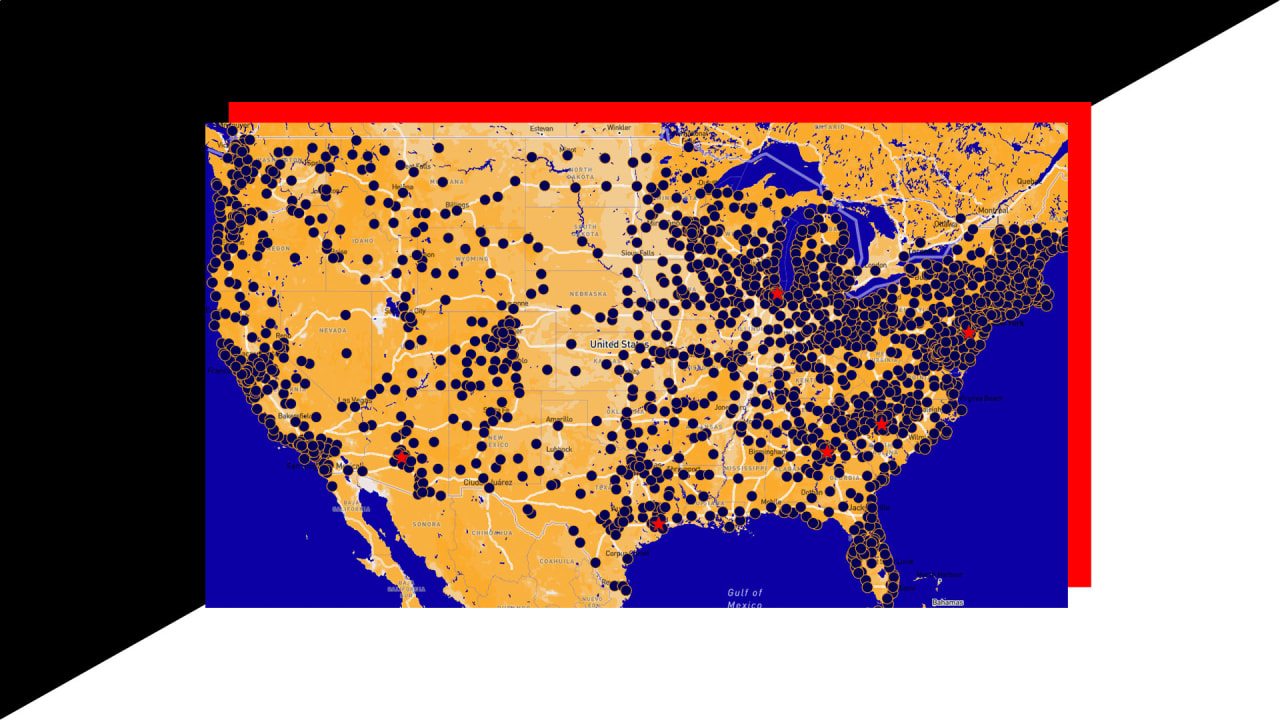

As a wave of state-level retirement mandates quietly rolls out across the country, most small businesses aren’t prepared. More than 30 states have proposed mandates that would require small businesses to offer a retirement plan, and 10 states already have active state-sponsored retirement plans.

California, the largest state economy, is leading the charge. By the end of this year, all California businesses with at least one employee must offer their employees a retirement benefit, either a 401(k) or enrollment in the state-run CalSavers program. By the end of 2025, those that don’t could end up paying fines of up to $750 per employee, with more penalties added annually until they comply.

That would be troubling on its own. But in a recent Guideline survey of California small business owners, 75% weren’t familiar with CalSavers and 65% didn’t know about the fines. While the intention behind the legislation is good, the execution is falling short.

Expanding access to retirement savings is important. About 7.5 million Californians lack access to a workplace retirement plan, and most of them work for small businesses. But when 98% of firms in the state have fewer than 100 employees, poor execution turns into a statewide problem.

What’s happening in California is just the beginning. For small business owners across the country, this is a preview of what’s coming next—from hidden compliance traps to unexpected penalties. The result: Policies meant to help workers are instead creating confusion, compliance headaches, and financial risk for the country’s most vulnerable employers.

A system designed without small businesses in mind

Many small business owners I talk to want to help their employees and offer retirement benefits. But they’re also stretched thin, juggling HR, payroll, compliance—and now, state-level mandates that come with little warning and even less education.

In Guideline’s survey, 70% of California small business owners said managing a 401(k) is too complex, and 51% said it’s too expensive. Yet most had never heard of the SECURE 2.0 tax credits, which can cover 100% of the administrative cost of a 401(k) for the first three years. That’s a clear failure in communication.

So instead of unlocking access, these well-intentioned policies are creating traps: rules most businesses don’t know about, with fines they can’t afford.

The fine print matters

Meanwhile, many small businesses are defaulting to state-run programs like CalSavers, which are designed to be a simple option, but not necessarily a long-term solution. These programs don’t allow employer contributions and come with limited plan options. According to Guideline research, 47% of employers who tried CalSavers shared that their employees thought the set up and management were difficult to use.

That’s why many employers nationally are opting to offer their own 401(k) plans instead. It’s not because they have to, but because they want to attract talent, retain employees, and build long-term loyalty. When the playing field is level—meaning tax credits, modern tech, and low-cost plans are accessible—small businesses can offer big-company benefits.

What small businesses should do now

Whether or not your state has a mandate, it’s worth paying attention to what’s happening in California. Here are some helpful tips for any small business owner:

- Check your state’s retirement rules. You might be surprised to learn what’s already in place.

- Consider your options. You don’t have to default to a state-run program, especially when a private 401(k) could cost less than you think.

- Review federal tax credits. If you qualify, you might get your plan fully paid for over the next few years.

- Don’t wait for a fine to start planning. Retirement benefits are becoming important, as a cost of doing business, and may provide a competitive edge in hiring.

Mandates shouldn’t be a minefield

Retirement access can be critical. But when small businesses are blindsided by mandates, miss deadlines they didn’t know existed, and face unexpected fines, we’re not expanding access—we’re undermining it.

For small businesses to succeed, we need to design policies with their reality in mind. That means better communication, simpler solutions, and real financial support, not just penalties. Because when small businesses thrive, so can their employees.

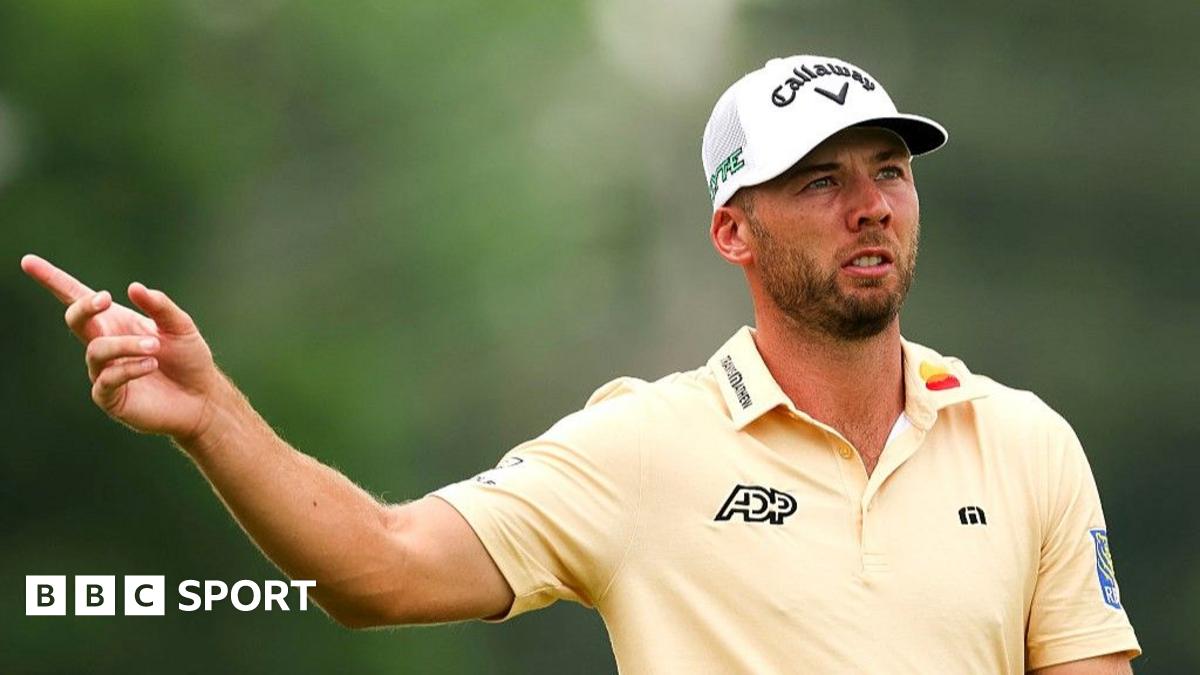

Kevin Busque is cofounder and CEO at Guideline.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0