Underwater mortgages are climbing in Florida and Texas housing markets

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

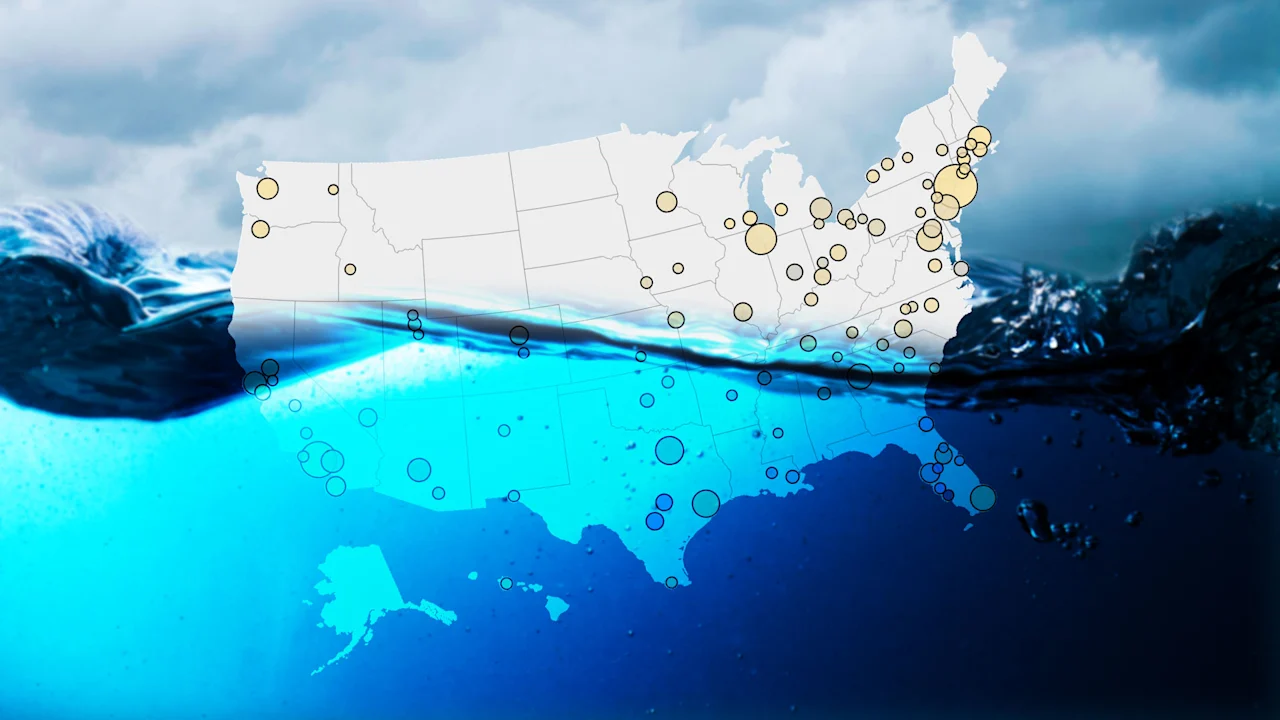

Since the Pandemic Housing Boom fizzled out in the summer of 2022, some overheated parts of the country—particularly in the West, Southwest, and Southeast—have experienced home-price declines from their peak (see this map).

While many of these markets have seen only modest drops, a few metro areas, such as Punta Gorda, Florida, and Austin have undergone what I’d consider “material” home-price corrections, falling 18.6% and 23.0% respectively from their peaks.

These regional home-price declines raise the question: How many mortgage borrowers are actually “underwater”—meaning their house is worth less than their outstanding mortgage balance—right now?

To find out, ResiClub reached out to ICE Mortgage Technology—formerly known as Black Knight, before it was acquired by Intercontinental Exchange for $11.8 billion in 2023.

- 1.0% —> The share of outstanding homeowner mortgages with negative equity (i.e., underwater) at the end of April 2025, according to data from ICE Mortgage Technology provided to ResiClub this week.*

- 23.0% —> The share of outstanding homeowner mortgages with negative equity (i.e., underwater) at the end of September 2009, according CoreLogic/FirstAmerica.

Why, on a nationally aggregated basis, are there still not many homeowners underwater, despite home-price declines in some markets?

- Nationally aggregate home prices are still pretty close to all-time highs. While many pockets of the West, Southwest, and Southeast have seen home prices decline at least some from the peak, nationally aggregated single-family prices are still pretty close to all-time highs.

- Amortization of ultralow mortgage rates. Many homeowners locked in ultralow mortgage rates during the Pandemic Housing Boom. With fixed rates around 2% to 3%, those monthly payments included a larger proportion of principal repayment from the start. That means borrowers have been paying down their balances more aggressively than they would under higher-rate loans. As of Q4 2024, 54% of outstanding mortgage holders have rates below 4.0%, which has helped some borrowers build equity faster and give them a greater buffer.

- Few buyers actually purchased at the peak in correction markets. Even in boom-to-correction markets like Cape Coral, Florida, or Austin, only a small share of homeowners bought at the absolute top of the market in spring 2022. Most current homeowners in those areas either bought before or after the peak. This limited exposure at the peak helps explain why negative equity, so far, hasn’t been a big problem, even in some of the hardest-hit metros.

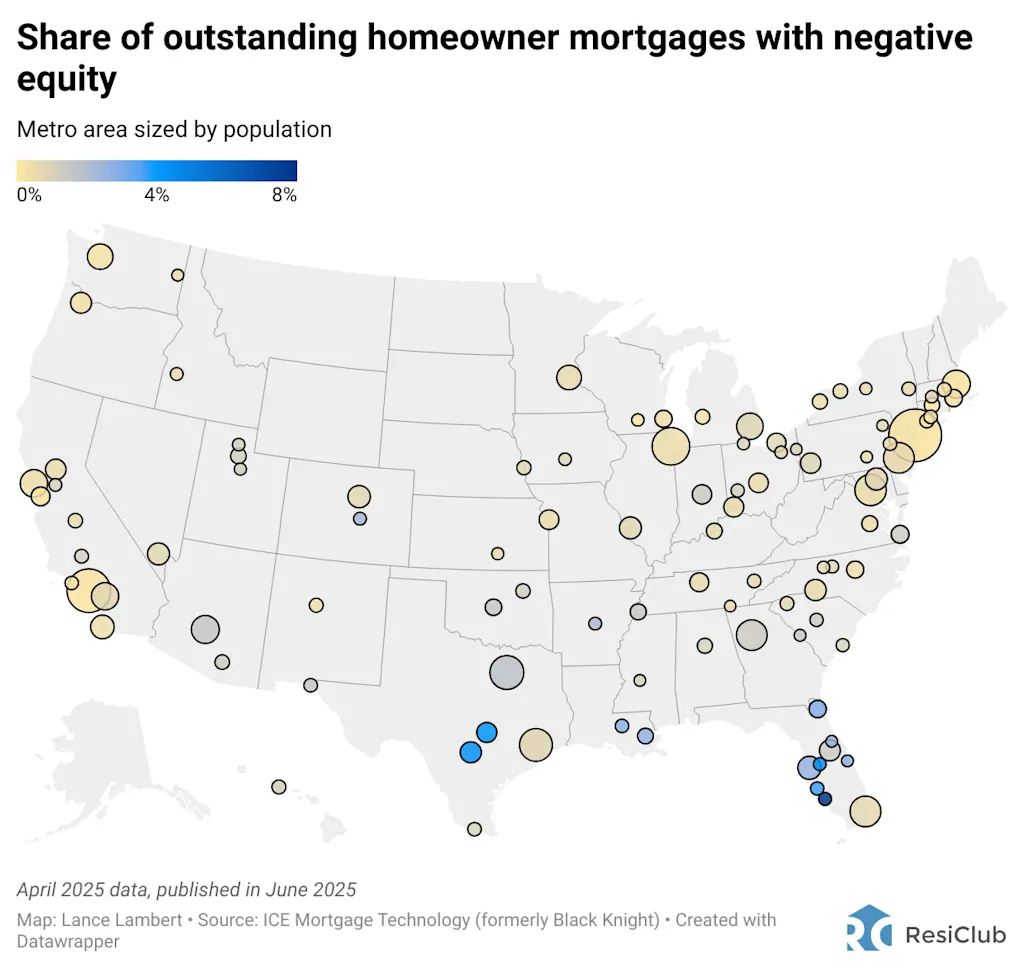

While only 1.0% of outstanding U.S. homeowner mortgages have negative equity, there are few pockets where it’s getting closer to 5.0%—or has even slightly crossed it.

Among the 100 major metro areas for which ICE Mortgage Technology provided data to ResiClub, these 15 metros have the highest share of homeowner mortgages currently underwater:

- Cape Coral, Florida —> 7.8%

- Lakeland, Florida —> 4.4%

- San Antonio —> 4.3%

- Austin —> 4.2%

- North Port, Florida —> 3.8%

- Jacksonville, Florida —> 2.9%

- Baton Rouge, Louisiana —> 2.8%

- Palm Bay, Florida —> 2.7%

- New Orleans —> 2.7%

- Deltona, Florida —> 2.6%

- Tampa, Florida —> 2.5%

- Colorado Springs, Colorado —> 2.3%

- Little Rock, Arkansas —> 2.2%

- Dallas —> 1.7%

- Oklahoma City —> 1.6%

Even in markets like Cape Coral (7.8%) and Austin (4.2%) that have higher shares of outstanding homeowner mortgages that are currently underwater, that’s still far off from the levels seen at the height of the Great Financial Crisis-era bust. For comparison, back in September 2009, a staggering 68% of mortgage borrowers in Nevada, 48% in Arizona, and 45% in Florida were underwater.

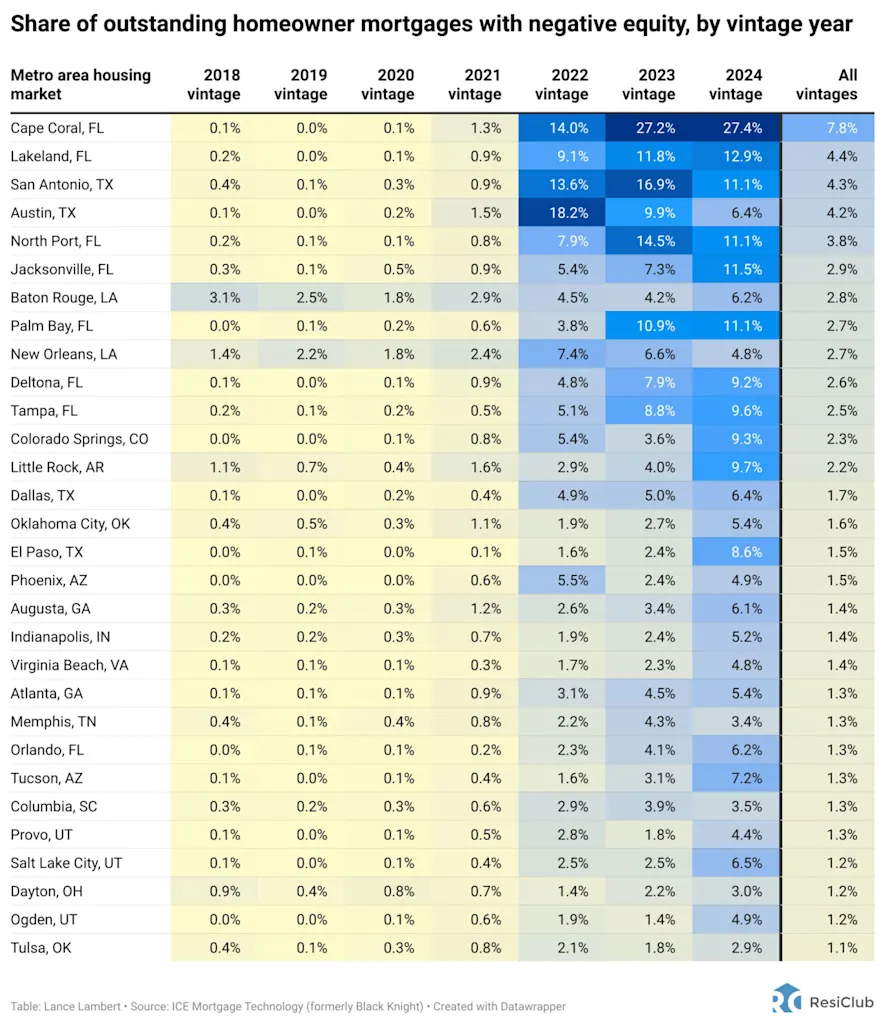

So far, in the down markets it’s really just the 2022, 2023, and 2024 vintages being impacted. Even in Austin—a metro where home prices have fallen 23% from their May 2022 peak—only 1.5% of 2021 borrowers are underwater.

Big picture: If home prices in parts of the Southwest, Southeast, and West continue to experience mild home-price pullbacks, the share of recent borrowers who are underwater in those markets will rise beyond the levels we’ve outlined here. However, barring a major downward shift, it still wouldn’t come close to the depths of negative equity seen in 2009 or 2010 anytime soon.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0