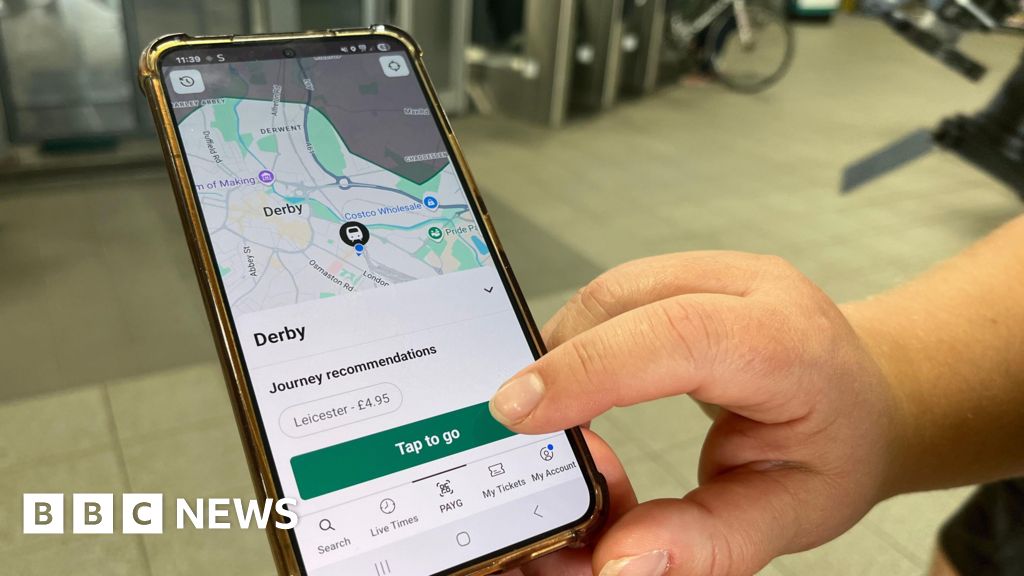

What Is Mobile POS and How Does It Function?

Mobile POS, or mPOS, is a payment processing system that enables you to conduct transactions using smartphones or tablets, offering flexibility for businesses. It works through a dedicated app linked to a card reader, allowing real-time payment processing by scanning items or entering charges. This system supports various payment methods, including mobile wallets, and can issue receipts in multiple formats. Comprehending its key components and advantages will reveal how it can transform operational efficiency for businesses.

Key Takeaways

- Mobile POS (mPOS) enables payment processing through smartphones or tablets, allowing transactions anywhere with an app and a card reader.

- Transactions are initiated by scanning items or entering charges, processing payments in real-time while updating inventory.

- mPOS solutions support various payment methods, including mobile wallets like Apple Pay and Google Pay for seamless transactions.

- Receipts can be provided in printed, emailed, or digital formats, enhancing customer convenience.

- Security measures like data encryption and PCI DSS compliance protect sensitive information and ensure secure transactions.

What Is Mobile POS?

A mobile point of sale (mPOS) system is a technology that allows businesses to process payments using smartphones or tablets, effectively replacing traditional cash registers.

This portable POS system is becoming increasingly popular, with 54% of retailers currently using it, and transactions projected to exceed $6 trillion by 2028.

mPOS solutions typically consist of an app paired with a card reader, facilitating seamless transactions in-store or on-the-go. They improve customer engagement by enabling faster checkouts and accepting various payment methods, including mobile wallets like Apple Pay and Google Pay.

Moreover, mPOS systems can integrate inventory management and sales reporting features, providing valuable insights for optimizing operations and boosting financial performance, making them a versatile choice for modern businesses.

How Does Mobile POS Work?

How does a mobile point of sale (mPOS) system actually function? Mobile POS solutions operate by downloading a dedicated app on your smartphone or tablet, connecting to a hardware card reader for payment processing.

You initiate transactions by scanning items or entering charges into the app, allowing customers to pay via credit/debit cards or mobile wallets. The system processes payments in real time and updates inventory accordingly.

- Receipts can be issued in printed, emailed, or digital formats.

- Many handheld POS systems for restaurants require a stable internet connection.

- Some systems offer offline capabilities for transactions without Wi-Fi.

- Improved customer flexibility is a significant advantage of mPOS systems.

Key Components of Mobile POS Systems

Mobile POS systems comprise several key components that work together to streamline transactions and improve operational efficiency.

At the heart of these systems are mobile POS devices, typically smartphones or tablets running specialized POS software. A card reader connects via USB-C or a lightning port, enabling secure transaction processing.

Additional hardware may include barcode scanners for quick item identification, cash drawers for cash transactions, and receipt printers to provide customers with proof of purchase.

Many portable point of sale systems likewise feature built-in NFC capabilities for contactless payments, facilitating transactions through mobile wallets like Apple Pay and Google Pay.

The software is often cloud-based, allowing you to access sales data, inventory management, and reporting from any internet-connected device.

Advantages of Mobile POS

Even though many businesses seek to improve their customer service and operational efficiency, adopting a mobile POS system offers several distinct advantages that can greatly impact their success.

By utilizing a handheld point of sale, you can elevate the overall customer experience and streamline operations. Here are some key benefits:

- Reduced wait times, leading to higher customer satisfaction and repeat business.

- Flexibility to process transactions anywhere, perfect for mobile operations like food trucks and event vendors.

- Integration of various payment methods, including mobile wallets and contactless payments, catering to diverse customer preferences.

- Real-time inventory tracking and sales reporting, enabling informed decision-making and efficient operations.

These advantages make mobile POS a crucial tool for modern businesses looking to thrive.

Industries That Benefit From Mobile POS

Numerous industries are leveraging mobile POS systems to boost their operations and improve customer interactions. Retailers use mobile POS terminals to assist customers directly on the sales floor, improving service and reducing wait times. Food service businesses, especially restaurants, benefit from handheld ordering devices for restaurants, allowing staff to take orders and process payments at the table. Event vendors and pop-up shops find mobile POS advantageous for accepting payments on the go, driving sales in various locations. Service-based industries like home repair can generate invoices and accept payments at job sites, streamlining transactions. The hospitality sector, including hotels and cafes, uses mobile POS to manage orders and payments seamlessly, improving the guest experience.

| Industry Type | Benefits |

|---|---|

| Retail | Improves customer service and reduces wait times |

| Food Service | Enhances order taking and payment processing |

| Event Vendors | Increases payment flexibility on the go |

| Service Industries | Streamlines transactions at job sites |

Security Considerations for Mobile POS Systems

In regards to securing your mobile POS system, data encryption techniques and user access control are key components you can’t overlook.

Implementing strong encryption guarantees that sensitive customer information remains protected during transactions, whereas establishing strict user access limits helps prevent unauthorized entry into your system.

Data Encryption Techniques

To guarantee the security of sensitive payment information in mobile POS systems, implementing robust data encryption techniques is crucial. These techniques protect your transactions, making sure customer data remains safe.

Here are some key methods you should consider:

- AES (Advanced Encryption Standard) for encrypting data at rest and in transit.

- RSA (Rivest-Shamir-Adleman) for secure key exchange and digital signatures.

- SSL (Secure Sockets Layer) to safeguard data transmitted between your wireless POS system and payment processors.

- Tokenization, which replaces sensitive card details with unique tokens, minimizing breach risks.

Furthermore, adhering to PCI DSS compliance guarantees that your mobile point of sale systems implement necessary encryption measures, further enhancing security and protecting cardholder data effectively.

Regular updates and end-to-end encryption are also crucial practices.

User Access Control

User access control is a crucial aspect of securing mobile POS systems, as it directly impacts the protection of sensitive customer information. To improve security, verify each employee uses unique user IDs and secure passcodes. Implementing strong authentication practices, like two-factor authentication (2FA), is critical for safeguarding data. Regular training on security protocols reduces human error, a common vulnerability in handheld POS systems.

| Access Level | Description |

|---|---|

| Admin | Full access to all features |

| Cashier | Limited access to transaction tools |

| Staff | Restricted access, no transactions |

Limiting access to key employees minimizes data breaches and allows for monitoring user activity, increasing accountability in your mobile POS machine.

Comparing Mobile POS Solutions

When comparing mobile POS solutions, it’s crucial to evaluate key features and costs.

For instance, whereas Square charges transaction fees of 2.6% plus 10 cents, Shopify has a monthly fee of $29 along with its transaction fees, which can impact your bottom line.

Moreover, think about the hardware you’ll need; some systems may require specific card readers, whereas others offer tap-on-phone technology for a more streamlined experience.

Key Features Overview

The terrain of mobile POS solutions is characterized by a variety of key features that cater to the diverse needs of businesses.

With a tablet point of sale system, you can process payments anywhere, utilizing smartphones or tablets along with card readers. Many wireless POS systems offer cloud-based functionality, ensuring seamless access to real-time data.

Key features to evaluate include:

- Customer loyalty programs that improve customer retention

- Expense tracking for better financial management

- Detailed sales analytics for informed decision-making

- Strong security measures to protect transaction data

These capabilities, alongside cost-effectiveness and lower upfront investments, make mobile POS solutions an attractive option for businesses operating in multiple locations or events.

Cost Comparison Analysis

Evaluating mobile POS solutions involves not just comprehending their key features but furthermore analyzing the costs associated with them.

Portable POS systems often have lower upfront costs than traditional POS terminals, as they typically require minimal hardware and can utilize existing smartphones or tablets.

Nevertheless, subscription fees and transaction costs can vary considerably. For instance, Square charges 2.6% plus 10 cents for each transaction, whereas PayPal Zettle offers a slightly lower rate of 2.29% plus 9 cents.

Some systems, like Shopify, charge a monthly fee ($29) along with transaction fees (2.7% for in-person).

Businesses should likewise consider scalability, as costs may increase with transaction volume, impacting overall budgets and operational efficiency.

Future Trends in Mobile POS Technology

As mobile POS technology evolves, businesses can expect significant advancements that will reshape the payment environment. The global mPOS market is projected to exceed $6 trillion in transactions by 2028, driven by increased adoption across various industries.

Key future trends include:

- Integration of AI and machine learning for personalized customer experiences and improved fraud detection.

- Growth of digital wallets and contactless payment options, catering to consumer preferences for quick, secure transactions.

- Incorporation of advanced analytics for real-time insights into customer behavior and sales trends.

- Strengthened security measures, such as biometric authentication and end-to-end encryption, to combat data breaches.

Investing in the best tablet for Square and utilizing pos handheld devices will be vital for businesses looking to stay competitive in this evolving environment.

Frequently Asked Questions

What Is the Difference Between Traditional POS and Mobile POS?

The main difference between traditional POS and mobile POS lies in their setup and flexibility. Traditional POS systems require fixed terminals and often involve high initial costs because of hardware needs.

Conversely, mobile POS systems use smartphones or tablets, allowing for transactions anywhere, which reduces costs and increases adaptability.

Furthermore, mobile systems typically offer subscription pricing, whereas traditional systems may need significant upfront investments, making mobile solutions more scalable for growing businesses.

What Is a POS System and How Does It Work?

A POS system is a technology that allows you to conduct sales transactions and manage operations efficiently.

It typically includes a terminal, software, and payment processing hardware. When you scan an item or enter it manually, the system calculates the total cost, processes payments, and updates inventory levels automatically.

This real-time data management helps streamline your business operations, making it easier to track sales and customer information accurately.

What Does the POS Function Do?

The POS function streamlines your sales process by allowing you to calculate prices, identify items, and process payments efficiently.

You can use a mobile device to scan barcodes, ensuring accurate inventory management. When a transaction is complete, the system adjusts inventory levels in real-time.

You additionally have the option to send digital receipts, enhancing customer experience. Furthermore, it supports various payment methods, making it adaptable to customer preferences and improving overall service efficiency.

Can I Use My Mobile Phone as a POS?

Yes, you can use your mobile phone as a POS by downloading an mPOS app. This turns your smartphone into a portable payment terminal.

You’ll need a hardware card reader, usually connecting via USB-C or Lightning port, for chip and contactless payments. Many mPOS systems support NFC technology, allowing tap-on-phone transactions without extra hardware.

This solution improves customer service by reducing wait times and processing payments directly at the point of service.

Conclusion

To conclude, mobile POS systems offer a flexible and efficient payment processing solution for businesses of all sizes. By integrating various payment methods and providing crucial features like digital receipts, they improve customer experience as they simplify operations. Industries such as retail, hospitality, and services greatly benefit from these systems. As technology advances, mobile POS is expected to evolve further, incorporating new features that enhance security and usability, ensuring businesses remain competitive in an increasingly digital marketplace.

Image Via Envato

This article, "What Is Mobile POS and How Does It Function?" was first published on Small Business Trends

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![Walter Boys Season 2 Finale Delivers Not One, But Two Cliffhangers — Is [Spoiler] Dead?](https://tvline.com/wp-content/uploads/2025/08/my-life-of-the-wlater-boys-season-2-finale_33d3b0.jpg?#)