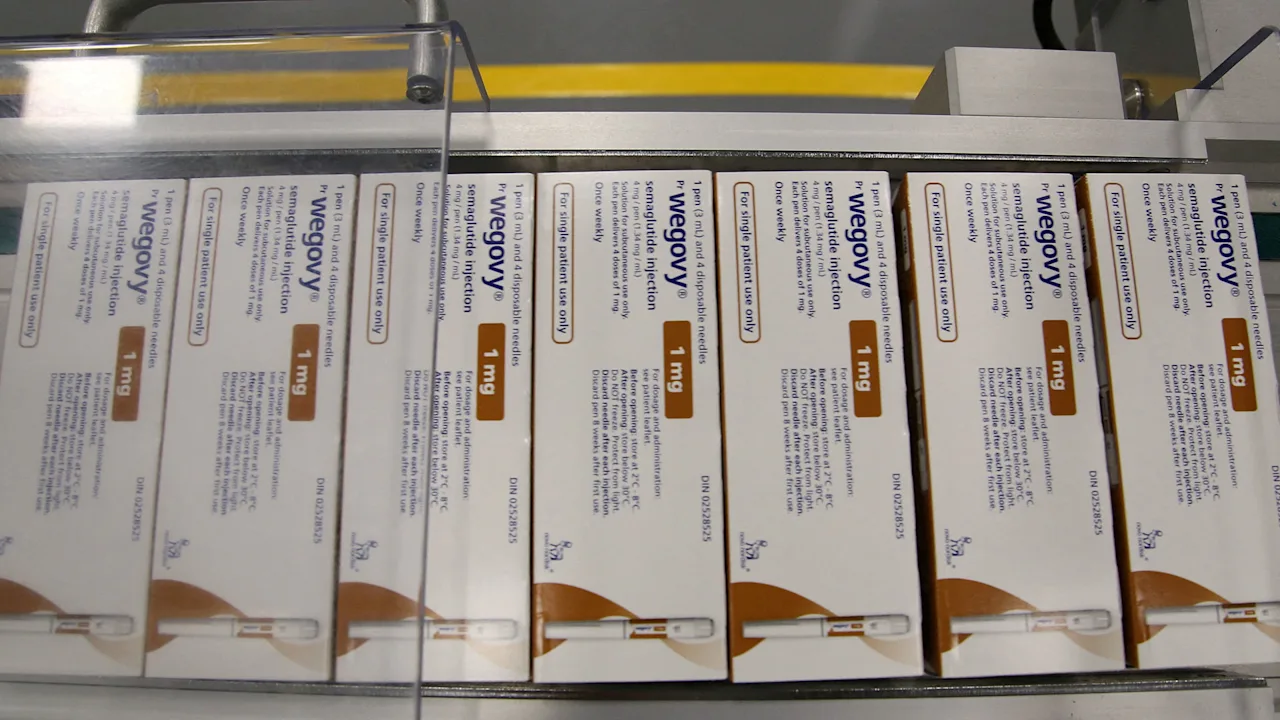

Blockbuster weight-loss drug Wegovy is losing market share in the U.S. Here’s why

Novo Nordisk cautioned on Wednesday that it expects continued competition this year from copycat versions of its Wegovy obesity drug, as it battled pressure from compounding pharmacies in the United States and rival Eli Lilly.

The Danish drugmaker, which became Europe’s most valuable company worth $650 billion last year on sales of its blockbuster weight-loss drug, is facing a pivotal moment as Wegovy loses market share, especially in the U.S.

Last week, competition from compounders — who make copycat medicines based on the same ingredients as Wegovy — prompted the company to cut its full-year sales and profit outlook. That took investors by surprise and wiped $95 billion off Novo’s market value.

On a media call on Wednesday, outgoing CEO Lars Fruergaard Jorgensen said the copycat market has “equal size to our business” and compounded versions of Wegovy were sold at a “much lower price point.”

In May, the company said it expected many of the roughly one million U.S. patients using compounded GLP-1 drugs to switch to branded treatments after a U.S. Food and Drug Administration (FDA) ban on compounded copies of Wegovy took effect on May 22, and it expected compounding to wind down in the third quarter.

However, CFO Karsten Munk Knudsen said on Wednesday that more than one million U.S. patients were still using compounded GLP-1s and that Novo’s lowered outlook has “not assumed a reduction in compounding” this year.

ENCOURAGING PRESCRIPTION DATA

Knudsen reiterated that the company was pursuing multiple strategies, including lawsuits against compounding pharmacies, to halt unlawful mass compounding of its blockbuster medicine.

Jorgensen said the company was encouraged by the latest U.S. prescription data for Wegovy. While Novo’s weight-loss drug was overtaken earlier this year by rival Lilly’s Zepbound in terms of U.S. prescriptions, that lead has narrowed in the past month.

Second-quarter sales of Wegovy rose by 36% in the U.S and more than quadrupled in markets outside the U.S. compared to a year ago, Novo said.

Barclays analysts said in a note that while Wegovy’s U.S. pricing held steady in the second quarter, the company expects deeper erosion in the key U.S. market in the second half, due to a greater portion of sales expected from the direct-to-consumer or cash-pay channel, as well as higher rebates and discounts to insurers.

Knudsen said it is expanding its U.S. direct-to-consumer platform, NovoCare, launched in March, and may need to pursue similar “cash sales” directly to patients, outside of insurance channels, in some markets outside the U.S.

COST CUTS

The company reiterated its full-year earnings expectations on Wednesday after last week’s profit warning reduced its 2025 sales outlook, and named veteran insider Maziar Mike Doustdar to take over from Jorgensen on Thursday.

Jorgensen said Novo was acting to “ensure efficiencies in our cost base” as the company announced on Wednesday it would terminate eight R&D projects. Doustdar said last week the company will pursue “savings and efficiencies.”

“There seems to be a larger R&D clean-out than usual, but we do not know if this reflects a strategic re-assessment or just a coincidence,” analysts at Jefferies said in a note.

Investors have questioned whether Novo Nordisk can stay competitive in the booming weight-loss drug market. Several equity analysts have cut their price targets and recommendation on the stock since last week.

Shares in Novo plunged 30% last week — their worst weekly performance in over two decades and were down 1.8% in morning trading on Wednesday.

Sales rose 18% in the quarter to 76.86 billion Danish crowns ($11.92 billion), below analysts’ initial expectations.

—Jacob Gronholt-Pedersen and Maggie Fick, Reuters

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0