Is your student loan getting taxed again?

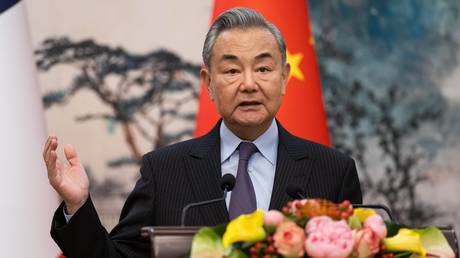

President Donald Trump’s One Big Beautiful Bill Act (OBBBA), recently signed into law, ushers in a number of new tax write-offs and credits. Some of those include the “No Tax on Tips” provision (which allows eligible tipped workers to deduct a portion of their income from tips on their federal income taxes), car loan and charitable donation deductions, and a child credit. However, other deductions that Trump’s tax bill did not renew will expire at the end of this year, including those related to student loan forgiveness. As a result, borrowers with certain federal student loans may have to pay more taxes.

“There are two things that student loan borrowers need to know: There are changes in the way student debt is taxed, and the other is Congress didn’t extend tax-free student loan forgiveness,” Mike Pierce, executive director of the Student Borrower Protection Center (SBPC), told Fast Company.

Some student loans may once again be taxed in 2026

“Forgiven student loan debt is generally considered taxable income in the year it’s discharged,” Miryam Wisnicki, tax principal at CliftonLarsonAllen, told Fast Company. “However, the American Rescue Plan Act of 2021 temporarily excluded certain types of student loan forgiveness from taxable income through December 31, 2025. This provision was enacted in response to the COVID-19 pandemic and aimed to provide relief to borrowers.”

But while student loan forgiveness remains tax-free through the end of 2025, it will be subject to income tax on the amount discharged starting at the beginning of 2026.

Which student loan provisions will remain tax-free?

The OBBBA did separately make some student-loan-related tax provisions permanent, according to Wisnicki:

- Loan discharge due to death or total disability will continue to be excluded from taxable income.

- Employer-provided student loan repayment assistance—up to $5,250 annually—will remain tax-free under qualified educational assistance programs. This benefit, previously set to expire at the end of 2025, is now permanent and will be adjusted annually for inflation.

New loan limits

While undergraduate loan limits won’t change, they will for graduate students and parent borrowers, NPR reported.

The new law puts a cap on unsubsidized student loans for graduate students at $20,500 per year and $100,000 for a lifetime (down from $138,500). It caps borrowing for professional degrees, for example in law or medicine, at $50,000 per year and $200,000 for a lifetime (up from $138,500). It limits federal student loan borrowing to a total of $257,500 for a lifetime (for both undergraduate and graduate studies).

It also caps borrowing for parents through the federal Parent PLUS loan program at $20,000 per year per student and $65,000 for a lifetime, which, according to the SBPC, could force millions into a risky private market. The law eliminates the Graduate PLUS loan program for all new students on July 1, 2026, gutting a critical financial aid program that had previously allowed eligible graduate and professional students to borrow up to the full cost of attendance for their advanced degree.

How will the new law affect repayment options?

After July 1, 2026, borrowers with new loans will have only two repayment options: a new standard option and a new Repayment Assistance Plan (RAP) option based on income.

Current borrowers with loans taken out before July 1, 2026, will continue to have access to an Income-Based Repayment (IBR) plan and can continue to enroll in or remain on an Income-Driven Repayment plan, but will need to switch to IBR or RAP by July 1, 2028. Current borrowers who take on any new loan after July 1, 2026, including a consolidation loan, will be eligible only for RAP or the new standard plan, per the SBPC.

According to NPR, experts have said monthly RAP payments for many middle-income borrowers will be lower compared with earlier RAP plans, but not as low as they were on the previous Saving on a Valuable Education option. Meanwhile, the lowest-income borrowers will make a minimum monthly payment of $10, or $120 per year, instead of $0.

“Congress eliminated the most generous repayment terms and replaced it with a new plan that will cost more money,” Pierce explained. “It is making sure that the lowest-income borrowers have to pay something.”

There are still many ways to get your student debt canceled, Pierce said, but the canceled debt will be treated as taxable income: “For example, an average borrower who earns $50,000 a year would end up paying $2,200 more in taxes a year for every $10,000 that is canceled.”

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0