These states are seeing the biggest housing market inventory shift

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

When assessing home price momentum, ResiClub believes it’s important to monitor active listings and months of supply. If active listings start to rapidly increase as homes remain on the market for longer periods, it may indicate pricing softness or weakness. Conversely, a rapid decline in active listings could suggest a market that is heating up.

Since the national Pandemic Housing Boom fizzled out in 2022, the national power dynamic has slowly been shifting from sellers to buyers. Of course, across the country that shift has varied significantly.

Generally speaking, local housing markets where active inventory has jumped above pre-pandemic 2019 levels have experienced softer home price growth (or outright price declines) over the past 36 months. Conversely, local housing markets where active inventory remains far below pre-pandemic 2019 levels have, generally speaking, experienced more resilient home price growth over the past 36 months.

Where is inventory heading deeper into summer? As ResiClub communicated to ResiClub PRO members in late 2023—and reaffirmed last fall—we expect national active inventory to approach pre-pandemic 2019 levels in the second half of 2025. That’s still the trajectory we’re on.

National active listings are on the rise (+28.9% between June 2024 and June 2025). This indicates that homebuyers have gained some leverage in many parts of the country over the past year. Some sellers markets have turned into balanced markets, and more balanced markets have turned into buyers markets.

Nationally, we’re still below pre-pandemic 2019 inventory levels (-11.3% below June 2019) and some resale markets, in particular big chunks of Midwest and Northeast, still remain tight-ish.

June inventory/active listings* total, according to Realtor.com:

- June 2017 -> 1,292,371 📉

- June 2018 -> 1,216,504 📉

- June 2019 -> 1,219,807 📈

- June 2020 -> 871,557 📉

- June 2021 -> 492,425 📉 (overheating during the Pandemic Housing Boom)

- June 2022 -> 573,650 📈

- June 2023 -> 614,326 📈

- June 2024 -> 839,992 📈

- June 2025 -> 1,082,520 📈

IF we maintain the current year-over-year pace of inventory growth (+242,528 homes for sale), we’d have:

- 1,325,048 active inventory come June 2026

- 1,567,576 active inventory come June 2027

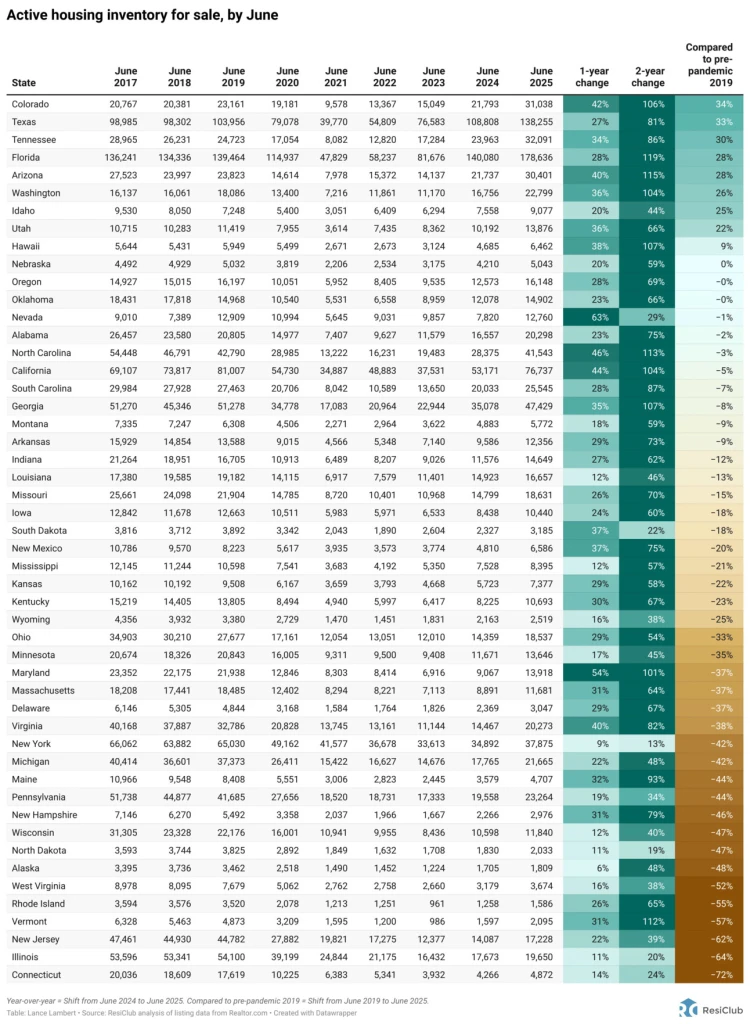

Right now, we’re looking at state inventory data. (ResiClub PRO members [paid tier] will get our monthly deep dive analysis looking at inventory shifts and signals for over 800 metro areas and 3,000 counties.)

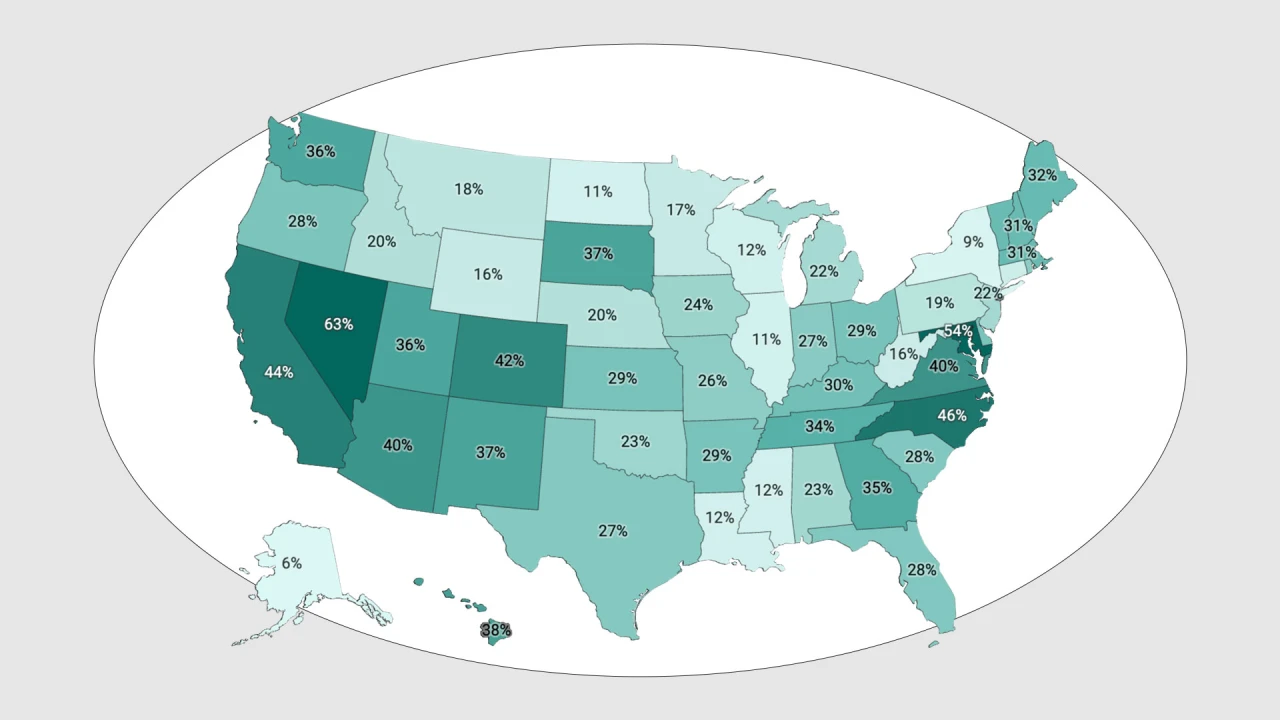

Below is the year-over-year percentage change by state.

Click here to view an interactive version of the year-over-year map below

While active housing inventory is rising in most markets on a year-over-year basis, some markets still remain tight-ish (although it’s loosening in those places too).

As ResiClub has been documenting, both active resale and new homes for sale remain the most limited across huge swaths of the Midwest and Northeast. That’s where home sellers this spring had, relatively speaking, more power.

In contrast, active housing inventory for sale has neared or surpassed pre-pandemic 2019 levels in many parts of the Sun Belt and Mountain West, including metro area housing markets such as Punta Gorda and Austin. Many of these areas saw major price surges during the Pandemic Housing Boom, with home prices getting stretched compared to local incomes. As pandemic-driven domestic migration slowed and mortgage rates rose, markets like Tampa and Austin faced challenges, relying on local income levels to support frothy home prices. This softening trend was accelerated further by an abundance of new home supply in the Sun Belt.

Builders are often willing to lower prices or offer affordability incentives (if they have the margins to do so) to maintain sales in a shifted market, which also has a cooling effect on the resale market: Some buyers, who would have previously considered existing homes, are now opting for new homes with more favorable deals. That puts additional upward pressure on resale inventory.

In recent months, that softening has accelerated again in West Coast markets too—including much of California.

Click here to view an interactive version of the map below

At the end of June 2025, 10 states were above pre-pandemic 2019 active inventory levels: Arizona, Colorado, Florida, Idaho, Hawaii, Nebraska, Tennessee, Texas, Utah, and Washington. (The District of Columbia—which we left out of this analysis—is also back above pre-pandemic 2019 active inventory levels too. Weakness in D.C. proper predates the current admin’s job cuts.)

Big picture: Over the past few years we’ve observed a softening across many housing markets as strained affordability tempers the fervor of a market that was unsustainably hot during the Pandemic Housing Boom. While home prices are falling in many pockets of the Sun Belt, a big chunk of Northeast and Midwest markets saw a little price appreciation this spring. That said, given the current softening, ResiClub expects that as the year progresses, more markets will fall into the year-over-year decline camp.

Below is another version of the table above—but this one includes every month since January 2017.

If you’d like to further examine the monthly state inventory figures, use the interactive below. (To better understand ongoing softness and weakness across Florida, read this ResiClub PRO report.)

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0