How gig economy thinking is transforming rental investing

Many real estate investors don’t set out to build rental businesses. Rather, they stumble into them. Think of the Gen Xer who just inherited their parent’s home, the professional who’s moving out of state for a new job but is reluctant to sell their current home, or the empty nester who bought a townhome for their college student to live in and is renting extra rooms out to other students.

We see many of these “accidental investors” applying gig economy principles to manage their properties with the precision, efficiency, and professionalism of full-time operators, without traditional overhead.

Instead of relying on manual processes, accidental operators are embracing a tech-forward, efficiency-driven approach that mirrors how gig workers treat rideshare, delivery, or freelance work: Generate income with maximum efficiency and minimal friction, while building flexible systems that scale.

Embrace the gig economy blueprint

The gig economy didn’t just disrupt industries—it rewired expectations. Rideshare drivers, delivery couriers, and freelancers embraced flexible, app-enabled platforms that allowed them to monetize time, skills, and assets without needing to build infrastructure themselves.

These platforms emphasized speed and user experience, qualities that became the gold standard across industries. Whether someone was delivering food, designing a logo, or driving someone to the airport, the mindset was the same: Use tech to accomplish more with less effort.

That same logic is now being applied to real estate investing.

A gig economy approach to rental operations

Gig economy thinking favors systems over sweat. Instead of building massive operations, part-time rental investors prefer to think like gig workers, plugging into tools that do the heavy lifting. That means ditching time-consuming manual processes for technologies that simplify and streamline virtually all aspects of managing properties. Here’s how they do that.

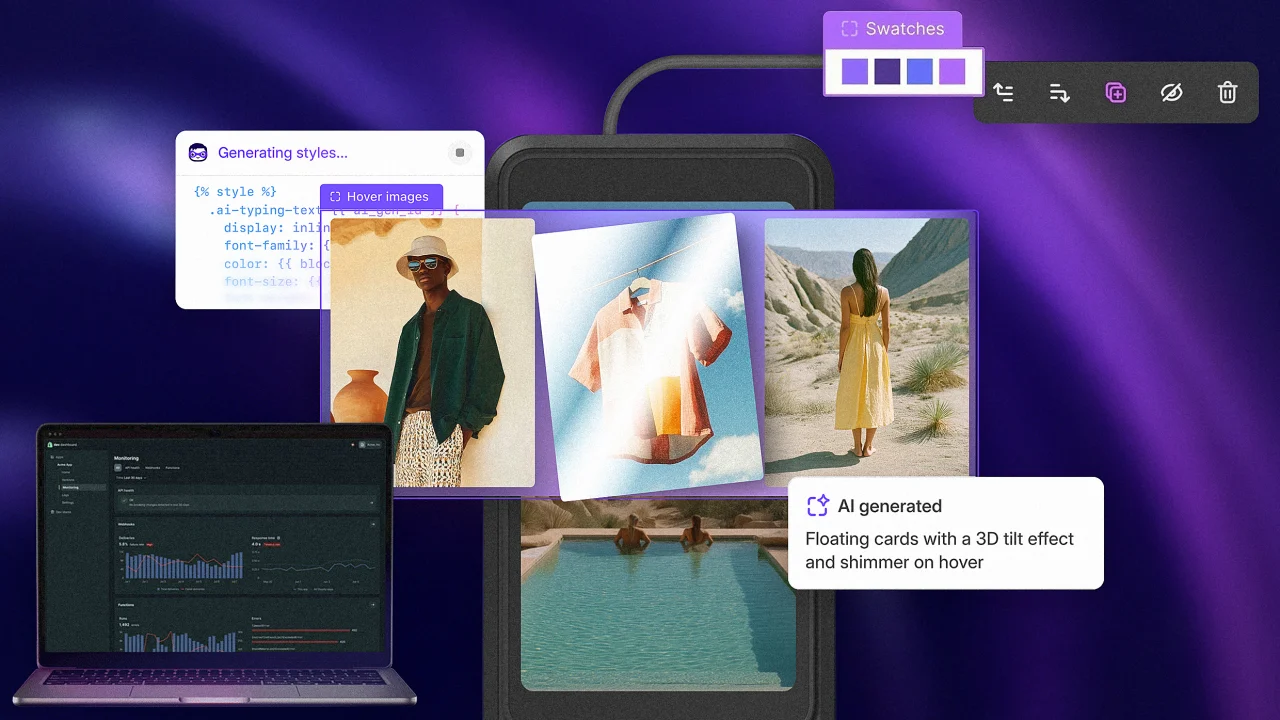

Automation as infrastructure: Mirroring the way gig platforms consolidate multiple functions into one easy-to-use app, investors are turning to mobile-first platforms to handle everything. What used to take hours of work to manage property listings, tenant screening, lease signing, rent collection, maintenance coordination, and communication now takes just a few taps on a phone.

Automation not only saves time but also ensures consistency. Rent reminders are sent automatically. Late fees are triggered when appropriate. Maintenance workflows keep tenants, vendors, and owners updated in real time. These tools create a seamless operating backbone that allows even part-time investors to run their portfolios like a professional business without needing a large back office, much like a rideshare driver operating solo but supported by enterprise-grade technology.

Customer experience mindset: Similar to how gig platforms prioritize customer convenience, tenants benefit from more attention with less effort on the investor’s part, thanks to tech that provides 24/7 access to services from convenient digital rent payment options to submitting and tracking maintenance requests any time of the day or night.

Additional perks like credit-boosting features that report on-time rent payments help improve tenants’ financial standing enhance satisfaction and retention, a dynamic common across gig platforms.

Data-driven decision making: Inparallel to how gig workers use ratings, earnings dashboards, and performance data to refine their approach, real estate investors now have access to real-time insights that help them optimize key aspects of their portfolio without relying on spreadsheets or guesswork.

Analytics such as rent collection trends, on-time payment rates, maintenance performance, expense breakdowns, and occupancy patterns provide a clear picture of what’s working and where improvements can be made. These tools allow investors to fine-tune pricing strategies, manage turnover, forecast cash flow, and control repair costs with greater confidence and precision.

In short, real estate investors are managing systems with the same mindset that defines successful gig economy operators.

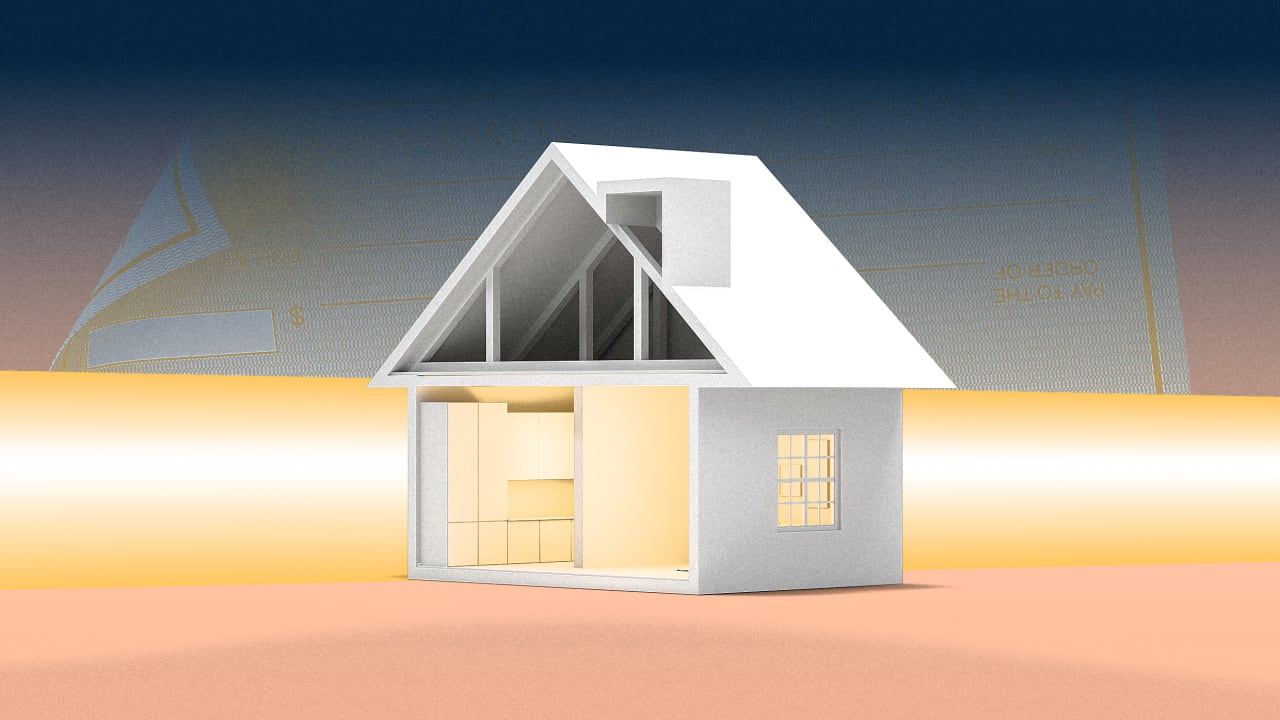

Turn passive income into a streamlined operation

Real estate investing has always promised passive income—but in practice, the day-to-day demands of managing properties often told a different story. Now, thanks to automation and centralized platforms, today’s investors are much closer to realizing the true potential of passive income. They can reduce the time, effort, and stress traditionally involved in managing rentals.

Automated rent collection eliminates the need for paper checks and late-night accounting. Features like automatic reminders, late fees, and autopay help ensure payments come in on time without the investor needing to chase tenants or manually track balances.

Maintenance coordination is now a seamless process. Tenants can submit requests through the app at any hour. Vendors can respond directly. Everything from work orders to invoices is logged automatically. This prevents after-hours disruptions and keeps all parties informed in real time.

Pre-screening and leasing tools further reduce the time investment. Investors can quickly identify high-quality tenants using built-in scoring systems that evaluate applicants on key risk factors, offering an instant snapshot of whether a candidate is a strong fit, a conditional accept, or potentially high risk. This helps fill vacancies faster and with greater confidence, lowering turnover and vacancy rates.

Gig economy thinking is about doing less, better. By setting up efficient systems, today’s real estate investors are building flexible, resilient rental businesses that demand far less hands-on time than in the past. Technology not only reduces work—it empowers investors with greater control and visibility, without adding friction to the process.

A growing segment with institutional-level ambition

Many accidental operators start small, but today’s tech makes it easier than ever to scale. With digital platforms and streamlined systems, these investors are closing the gap between independent and institutional players—not in size, but in sophistication.

The same tools that help part-time investors operate like seasoned professionals are raising industry standards. In many cases, they now deliver faster service, stronger communication, and greater transparency than traditional operators.

Just as Uber and Airbnb empowered individuals to transform entire industries, tech-enabled investors are reshaping the future of real estate, one property at a time.

Ryan Barone is cofounder and CEO of RentRedi.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.png?width=1200&auto=webp&trim=0,0,0,0#)