How to use the clean energy tax credits before they’re gone

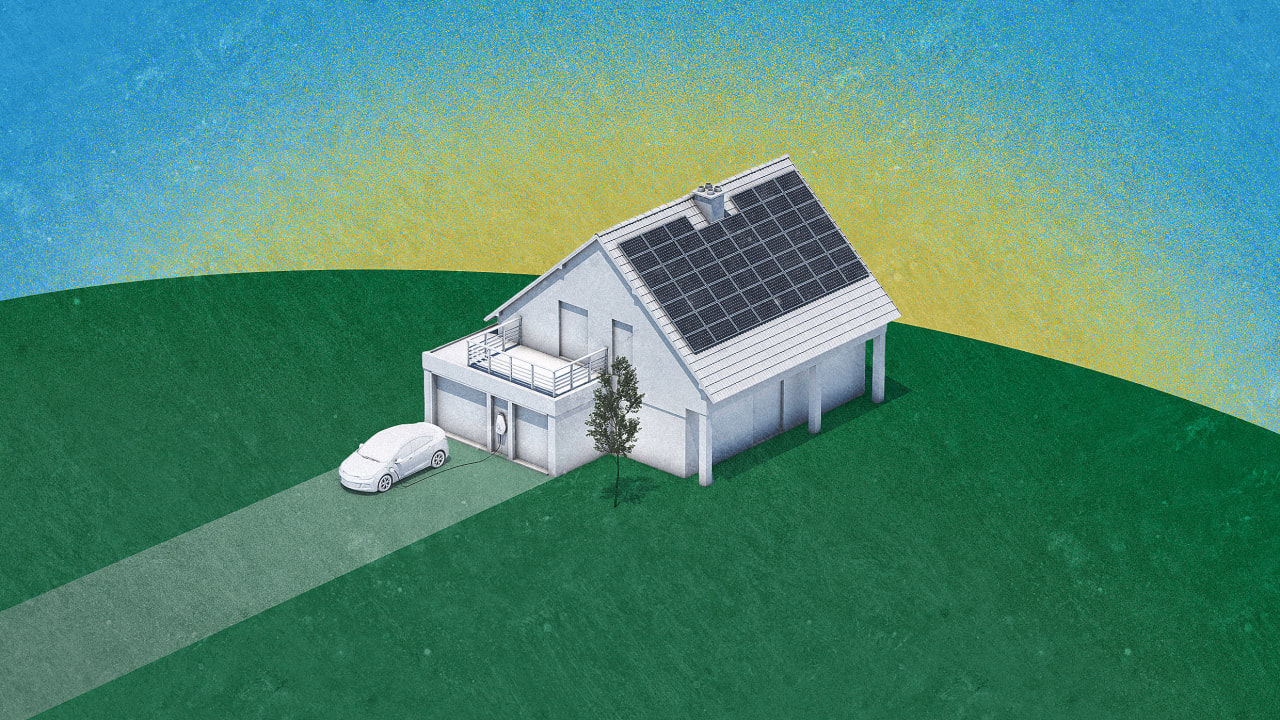

If you want to buy an electric vehicle—or solar panels or a heat pump or home battery—there’s a short window of time to make use of the existing federal tax credits currently available. Under the Inflation Reduction Act, the tax credits were supposed to last 10 years. Now, thanks to the Republican One Big Beautiful Bill, there are only about 10 weeks left to claim the EV tax credits before they disappear. Other clean energy tax credits will expire at the end of the year. Here’s what you need to know if you want to make use of them to help cut emissions and save on your energy bills.

New electric vehicles

Deadline: September 30

If you need a new car, it’s a good time to get an EV. Models qualify for a tax credit of up to $7,500 if they’re assembled in North America and meet American sourcing requirements for battery parts and critical minerals. There’s a price limit of $55,000 for cars and $80,000 for trucks, and an income limit for taxpayers ($150,000 for single filers). You can claim the credit on your tax return next year, but many dealerships also offer the option to transfer the credit to the dealer and get an immediate discount. For foreign-made EVs, you may still be able to get a discount if you lease a car through a loophole that classifies leased cars as “commercial clean vehicles.” The dealer can get the tax credit and pass on the savings to you.

Used electric vehicles

Deadline: September 30

The market for used EVs is booming; they’ve outsold used gas cars for five out of the last seven months. More than a third of the EVs available now are under $25,000. That’s the price limit for used cars to qualify for a $4,000 tax credit. (Cars also have to be purchased from a licensed dealer, be at least two years old, and on resale for the first time.) The income limit for taxpayers is lower than for new cars: For a single person, your adjusted gross income needs to be $75,000 or less.

EV chargers

Deadline: June 2026

If you need an EV charger in your garage, you have more time to make your purchase: The tax credit of up to $1,000 doesn’t expire until next summer.

Rooftop solar

Deadline: December 31

Like some of the other clean energy credits, the tax credit for solar panels existed long before the Biden administration. For the past 20 years, if you installed solar panels or solar shingles on your roof, you could get a 30% tax credit (on average, worth around $4,600). Now it’s going away. Adding solar to your home can help save thousands per year on electric bills. If you pair the panels with home battery storage, you can also have clean backup power when the grid goes down.

If you lease solar panels rather than buying them, the incentives last a little longer: Companies that lease solar can claim federal tax credits until 2027 and pass on savings to you. But because tariffs are pushing prices up, it may still make sense to act sooner.

Battery storage, including some induction stoves

Deadline: December 31

Even if you don’t have rooftop solar, a home battery can help you save money and cut emissions by storing electricity when there’s extra renewable energy available on the grid. To qualify for the current 30% tax credit, the battery must have a capacity of at least 3 kilowatt-hours. It includes sleek wall units and even high-end induction stoves that double as battery storage. Like companies that lease solar, those that lease batteries have longer to claim tax credits—until the 2030s, in this case.

Geothermal heating

Deadline: December 31

Even if you live in a climate that’s sweltering in the summer and freezing in the winter, the temperature underground stays steady. Geothermal heat pumps tap into this, transferring heat into a house in the winter and reversing the process in the summer to keep the house cool.

They’re pricey, with costs ranging from $15,000 to $35,000 or more. The current tax credit offers 30% of the cost of the tech and installation, with no cap and no income limit for the taxpayer. Again, there’s a longer timeline for companies that lease geothermal systems to claim credits and offer consumers some savings.

Air-source heat pumps

Deadline: December 31

Air-source heat pumps pull heat from the air, even in cold climates like Maine. Swapping out a gas furnace and air conditioner for air-source heat pumps (either a central system or mini splits) can help you save hundreds of dollars per year on energy bills. Heat pumps are around three times more efficient than traditional heating.

If your current HVAC system is nearing the end of its life, this could be a good time to invest. Heat pumps are pricey, with an average whole-home system costing nearly $20,000; a single-zone system can cost around $6,000. The current 30% tax credit has a cap of $2,000.

Water heaters

Deadline: December 31

A heat pump water heater is as much as four times as efficient as a standard water heater, and can help save around $200 per year for some homes. The current tax credit covers up to 30% of the cost, with a cap of $2,000. Solar water heaters, which use a rooftop system to heat water, are eligible for a 30% credit with no cap.

Weatherization, electrical upgrades, and home energy audits

Deadline: December 31

To help make your house more energy-efficient, you can get tax credits of up to 30% on insulation and air sealing ($1,200 cap); exterior doors (up to $500); and windows and skylights ($600). Electrical upgrades are capped at $600. (In total, weatherization and electrical upgrades can’t get a credit larger than $1,200 for the year.) Another tax credit offers $150 for a professional home energy audit.

Next steps

Under the IRA, with incentives that would have been in place for a decade, homeowners could slowly make upgrades as existing equipment wore out. Now they have to make harder decisions about what to prioritize in the next few months. Even without the tax credits, there are still thousands of other incentives in place from states, local governments, and utility companies. The savings calculator from the nonprofit Rewiring America can help you find additioal ways to save. The IRA’s rebates for clean energy products weren’t cut in the reconciliation bill, and some states have rolled out rebate programs using those funds.

Meanwhile, energy prices are expected to keep going up. That’s both because of the huge energy demand from companies like data centers and because the Big Beautiful Bill made it much harder to build new renewable energy, the cheapest source of new power.

Investing in solar, heat pumps, or other clean devices is “a way for homeowners to get themselves off the roller coaster of ever-increasing energy prices,” says Alex Amend, communications director at Rewiring America. Even without the tax credits to help with up-front costs, the new equipment can make sense financially over its lifetime. “As soon as you’ve flipped the switch, you’re going to be saving hundreds of dollars annually,” Amend says. “That’s still very much worth the investment.”

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0