KB Home’s housing market warning: Incentives might hide overpriced homes

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Since the Pandemic Housing Boom fizzled out, major homebuilders across various markets—especially in top pandemic boomtowns—have had to cut net effective home prices to avoid a deeper sales pullback. However, some builders, like Lennar and D.R. Horton, have primarily done so through larger incentives—such as mortgage rate buydowns—in part to protect community comps and avoid upsetting buyers already in their backlog.

Speaking to analysts on Tuesday, KB Home—which prefers outright home price cuts over incentives—said that some buyers turning to some of their competitors are effectively overpaying for new builds just to get rate buydowns, and if they need to sell in the immediate future, they might not be able to fetch the artificially high base price they paid.

“I believe that there are customers [of other homebuilders] that are overpaying for the home to effectively get an incentive. So they’re tied into this higher price that they’re gonna be stuck with forever until they sell that home. They may potentially be upside down when they try to sell that home versus a clean, simple, transparent way of selling—the value of what we offer,” KB Home COO Rob McGibney said on the builder’s June 23, 2025 earnings call.

Below are ResiClub’s other takeaways from KB Home’s Q2 earnings report and earnings call this week.

KB Home says the 2025 housing market is softer than expected

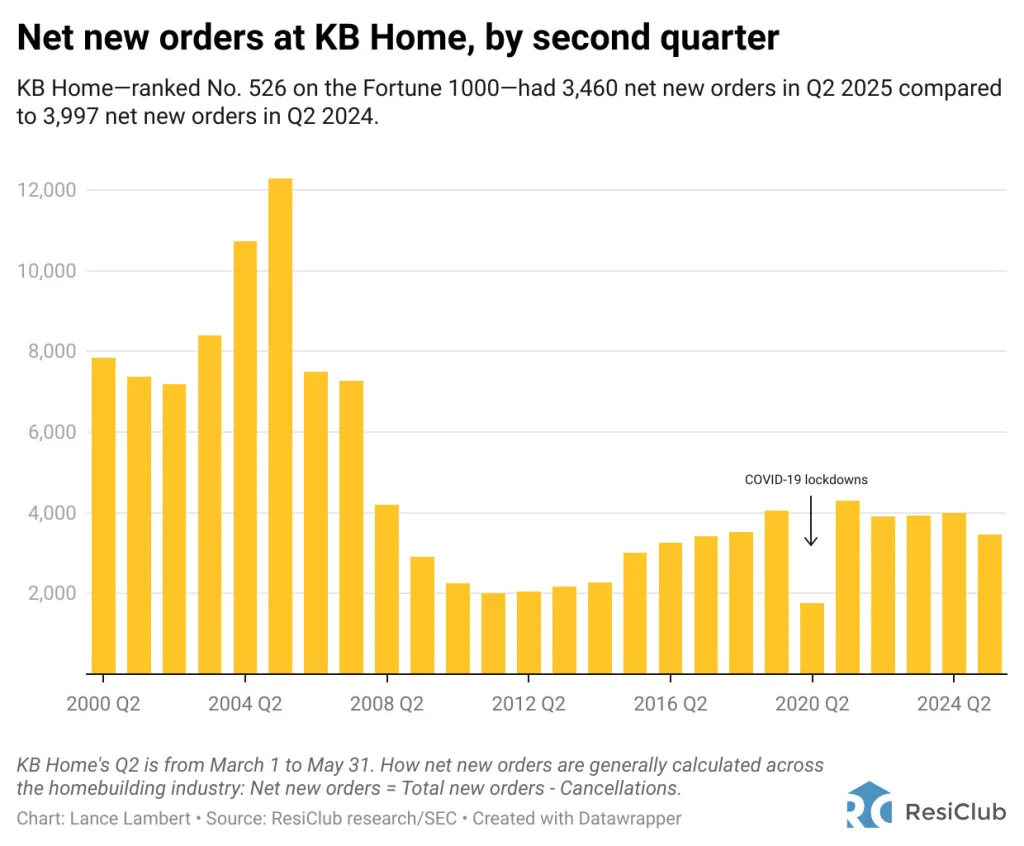

KB Home’s net new orders by Q2:

Q2 2018 —> 3,532

Q2 2019 —> 4,064

Q2 2020 —> 1,758 (COVID-19 lockdowns)

Q2 2021 —> 4,300

Q2 2022 —> 3,914

Q2 2023 —> 3,936

Q2 2024 —> 3,997

Q2 2025 —> 3,460

“The actions we began to take late in our 2025 first quarter, evaluating base pricing in every community relative to local market conditions, then repositioning our communities with a focus on offering the most compelling value, led to strong net orders in March. However, our net orders declined in April and May, which did not follow the typical spring trajectory,” said KB Home COO Rob McGibney.

McGibney added that: “As a result, even though our average community count was in line with our projection, and our cancellation rate was fairly steady, our monthly absorption pace per community was 4.5 net orders compared to 5.5 in last year’s second quarter. While our net order pace was below our internal goal, we believe it ranks high among the large production homebuilders.”

KB Home: “All of the markets we operate in experienced some level of softening at some point during the quarter”

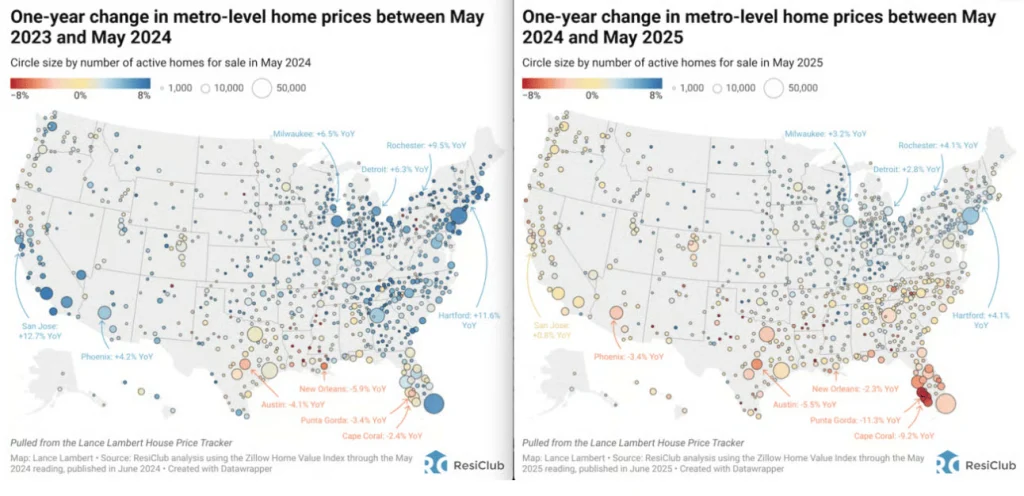

While the pricing story continues to be very local and vary a great deal across the country, most markets are at least seeing some softening.

“I would say that all of the markets we operate in experienced some level of softening at some point during the quarter,” KB Home COO Rob McGibney told investors on Tuesday. “Markets that I would say where we’re still seeing relatively strong demand and sales performance would be Las Vegas, the Inland Empire, the North Bay in Northern California, Texas markets like Houston and San Antonio.”

McGibney added that: “By contrast, some of the markets that are facing some more significant headwinds recently are like Sacramento and Seattle. They’ve slowed down a little bit, and we’ve had to do a little more there with price relative to some of the others. Markets like Austin and Colorado, Jacksonville, Orlando, and Florida [have been weaker too]. Places where resale supply has increased and starts putting pressure on pricing and creating more competition and just more choices for buyers. But, you know, it is very local, very specific, [we] can’t put a market condition on an entire state or even an entire market in most cases, it’s community by community.”

KB Home had to make some bigger price cuts in markets where resale inventory is above 6 months

On Tuesday, KB Home told analysts that it cut base home prices in half of its communities in the quarter ending May 31st.

“In the markets where you’ve seen resale inventory or resale supply get back to norms or above those norms of six or seven months of supply—those resales become a more formidable competitor than they were to us back when we would measure months of supply in terms of weeks instead of months. And on the flip side, most of the markets where resale supply has stayed fairly suppressed and limited, we’re tending to see better results there,” KB Home COO Rob McGibney told analysts on Tuesday.

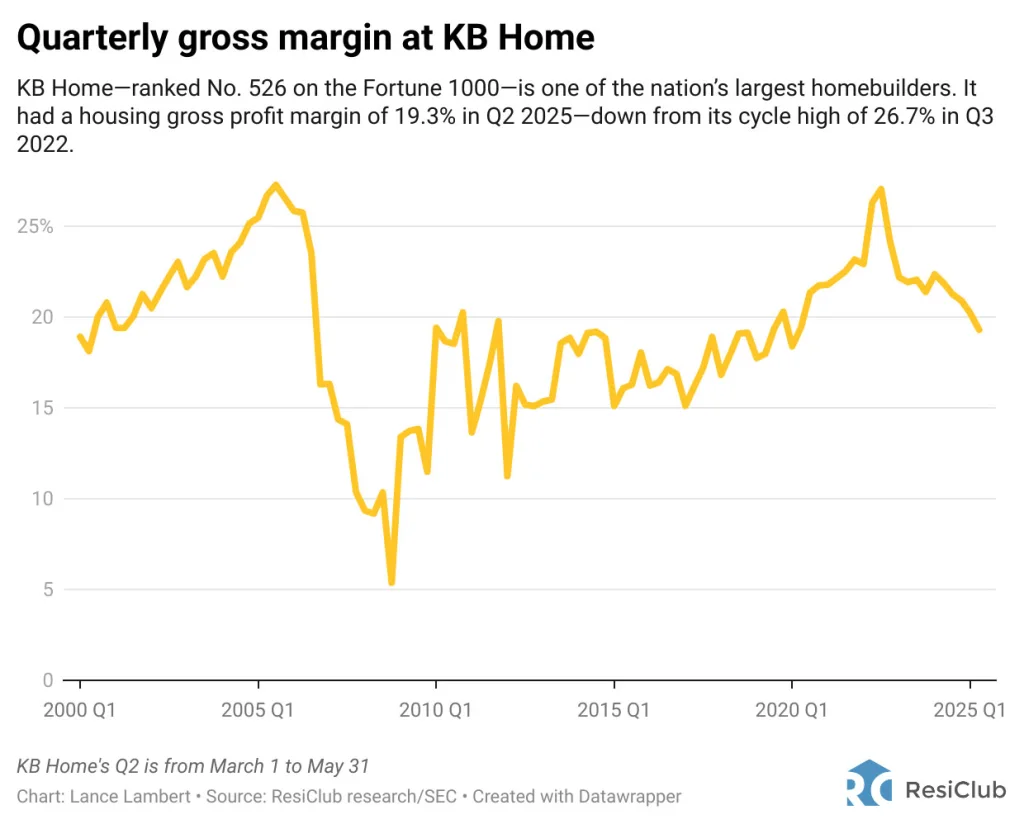

Margin compression continues

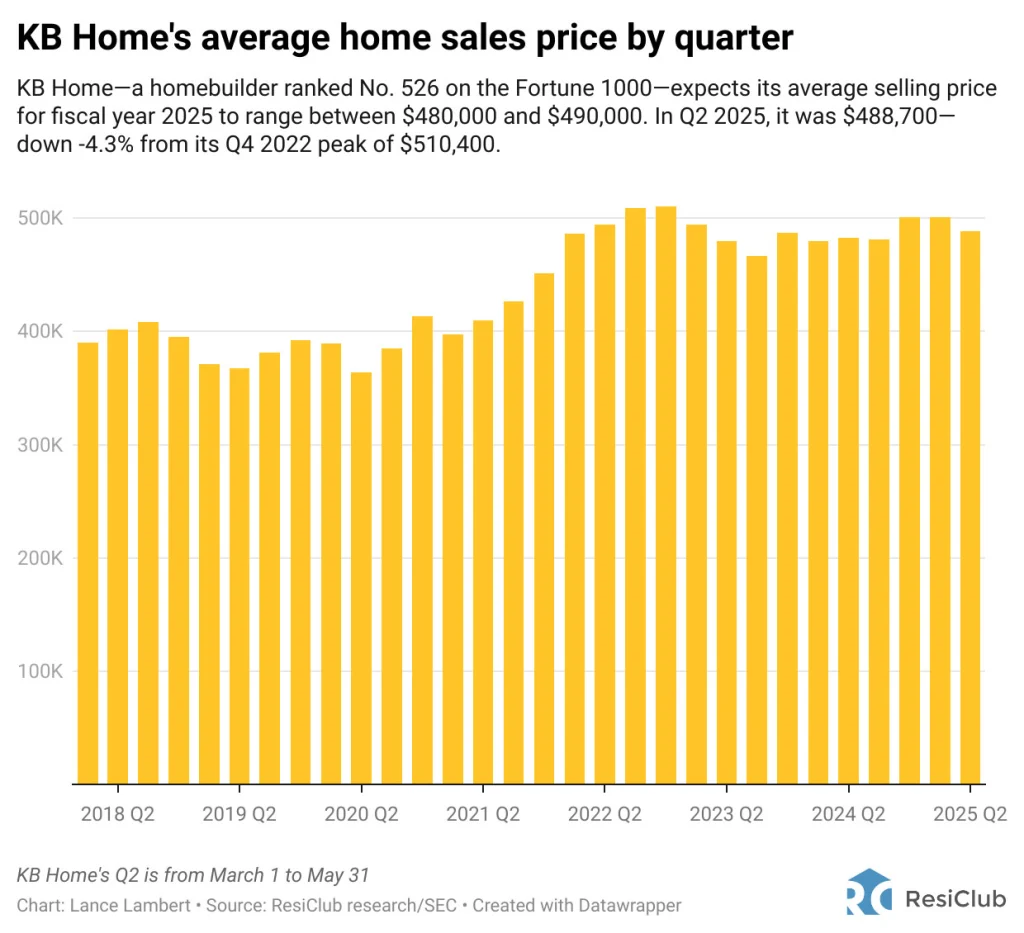

During the Pandemic Housing Boom, many publicly traded homebuilders achieved record profit margins as home prices soared and buyer demand ran red hot. Ever since the national housing demand boom fizzled out in the summer of 2022, many large homebuilders have reduced margin and made affordability/pricing adjustments where and when needed to maintain their sales pace or prevent a bigger sales pullback.

That includes KB Home, which reported a housing gross profit margin of 19.3% in Q2 2025—or 19.7% excluding inventory charges—down from a cycle peak of 26.7% in Q3 2022. Its margin has now compressed all the way back to pre-pandemic 2019 levels.

KB Home: “Only two minor price increases [related to tariffs] to date”

So far, tariffs haven’t had much impact on KB Home’s material costs.

“Homes that we started in May came in at the lowest cost per square foot year to date, as our divisions are continuing to drive better performance on cost. Our costs, including lumber, are protected for almost all of our third-quarter starts under the terms of our supply contracts. Our national purchasing team, working with our divisions, has done an excellent job holding off tariff-related cost increases, with only two minor price increases to date,” KB Home COO Rob McGibney told analysts on Tuesday.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0