Small Business Deduction Made Permanent in Major Legislative Win

In a significant victory for small business owners, the recently enacted “One Big Beautiful Bill Act” has made the 20% Small Business Deduction permanent, quelling fears of a potential tax hike. This landmark legislation, championed by the National Federation of Independent Business (NFIB), comes as a relief to entrepreneurs who have been navigating the uncertainties of the tax landscape.

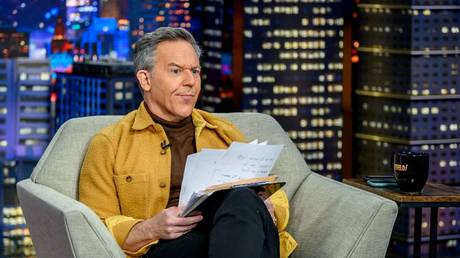

Brad Close, President of NFIB, emphasized the importance of this development during a recent episode of the NFIB’s “Small Business Rundown” podcast. “The 20% Small Business Deduction is something we focused on as our top federal priority for the last two years,” Close said. “And I’m pleased to say that… small business owners can plan. It was a huge victory… to being able to buy new equipment, pay down debt.”

For many small business owners, the Permanent Small Business Deduction represents a critical opportunity for financial planning. With the deduction in place, businesses can expect to see a reduction in their taxable income, translating to substantial savings that can be reinvested. This financial cushion can allow for purchasing new equipment, hiring additional staff, or even expanding into new markets.

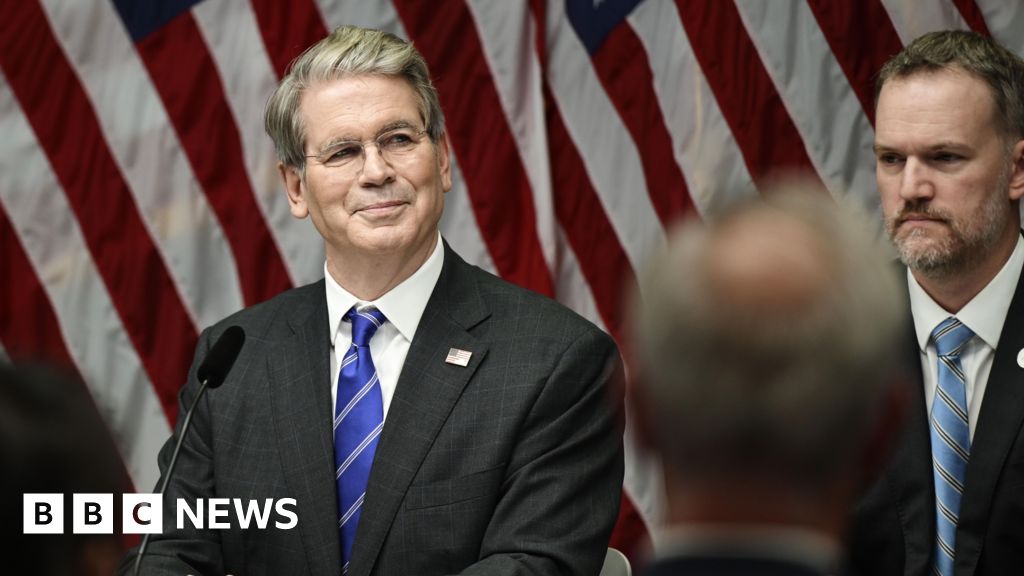

The legislation aims to support not just pass-through businesses — which account for a significant majority of small enterprises — but also C-corporations. According to Jeff Brabant, NFIB’s Vice President of Federal Government Relations, “the pass-through sector did great with the 20% Small Business Deduction… If you are the other 20% of small employers and you’re a C-corporation, your taxes didn’t go up either.” This reassurance to all types of small businesses fosters a climate of stability essential for growth.

However, while these tax benefits signal positive change, small business owners should remain vigilant. The landscape of federal tax legislation can shift considerably, and relying solely on current benefits may pose a risk in planning for the future. Understanding how these deductions apply to one’s specific business structure is vital. As the NFIB highlights, the permanence of the deduction has removed the annual trepidation of a potential tax increase, but small business owners must also consider their unique financial situations when determining how best to utilize these deductions.

Moreover, the “One Big Beautiful Bill Act” encapsulates additional wins beyond the Small Business Deduction that could enhance the resources available to small enterprises. Staying informed about these developments can provide owners with strategic insights and a competitive edge. The NFIB’s podcast serves as an ongoing resource for small business owners to stay updated on legislation that directly impacts them.

As the public discussions surrounding tax policy evolve, small business owners are encouraged to engage with organizations like NFIB, which advocate exclusively for their interests. Consistent communication with federal and state representatives can ensure that the voices of small business owners are heard.

This recent legislative victory underscores a pivotal moment for small businesses in America. With renewed confidence and concrete financial benefits from the permanent 20% Small Business Deduction, many entrepreneurs have the opportunity to look beyond survival and towards sustainable growth.

For further details on this significant tax relief and its implications, visit the NFIB’s press release here. Small business owners would do well to utilize available resources such as NFIB to navigate the evolving landscape and harness this momentum for their businesses.

Image Via Envato

This article, "Small Business Deduction Made Permanent in Major Legislative Win" was first published on Small Business Trends

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0