Avoiding Small Business Tax Mistakes: Essential Tips for Success

Key Takeaways

- Accurate Record Keeping is Essential: Maintain precise financial records using bookkeeping tools to avoid missing deductions and ensure IRS compliance.

- Correct Employee Classification: Understand the differences between employees (W-2) and independent contractors (1099) to prevent legal issues and increased tax liability.

- Maximize Deductions and Credits: Regularly research and claim all eligible tax deductions and credits to significantly reduce tax obligations, including home office deductions and tax credits for hiring.

- Adhere to Tax Deadlines: Stay informed about key tax filing and payment deadlines to avoid penalties and ensure compliance with state and federal tax laws.

- Seek Professional Tax Assistance: Consider hiring a tax professional to navigate complexities, optimize deductions, and maintain proper record keeping, especially for businesses with challenging financial situations.

- Implement Proactive Tax Planning: Set aside funds for tax liabilities and prioritize tax payments to alleviate financial stress and ensure smooth cash flow management.

Navigating the world of taxes can feel overwhelming, especially for small business owners. You’re juggling countless responsibilities, and it’s easy to overlook crucial details that could lead to costly mistakes. Understanding common tax pitfalls is essential for keeping your hard-earned money where it belongs—in your business.

From misclassifying employees to failing to claim deductions, small tax errors can snowball into significant financial headaches. By being aware of these common missteps, you can take proactive steps to protect your business and ensure compliance with tax regulations. Let’s dive into the most frequent tax mistakes small business owners make and how to avoid them.

Common Small Business Tax Mistakes

Understanding common small business tax mistakes helps you navigate the complex landscape of tax compliance. Avoid these pitfalls to protect your finances and ensure IRS compliance.

Failing to Keep Accurate Records

Failing to keep accurate records results in complications during tax filing. Use bookkeeping tools or tax software for precise tracking of income and expenses. Maintain documentation for business deductions, like the home office deduction, mileage deduction, and other write-offs. Without proper records, you risk missing out on potential tax savings and facing audits due to insufficient documentation.

Misclassifying Employees and Contractors

Misclassifying employees and contractors can lead to legal issues and increased tax liability. Understand the differences between W-2 forms for employees and 1099 forms for independent contractors. Misclassification affects payroll taxes, self-employment taxes, and tax filings. Adhere to IRS guidelines to correctly classify workers, ensuring compliance with federal and state tax laws. Consulting a tax advisor can further mitigate risks associated with employee classification.

Overlooking Deductions and Credits

Many small business owners overlook tax deductions and credits, leading to increased tax liability. Identifying and claiming all eligible deductions can significantly lower your tax obligations.

Not Claiming Home Office Deductions

Failing to claim the home office deduction is a common mistake. This deduction allows you to write off a portion of rent or mortgage interest, utilities, and office-related expenses if you operate your business from home. To qualify, measure the square footage of your dedicated workspace. Keep detailed records of all expenses related to that space. Utilizing tax software or consulting with a tax advisor ensures you maximize your tax savings.

Ignoring Available Business Tax Credits

Neglecting available tax credits can also inflate your taxes. Credits for research and development, hiring certain employees such as veterans, or making energy-efficient improvements can reduce your tax bill. Regularly research available small business tax credits and changes in tax laws. Staying informed about these opportunities can save you considerable amounts of money at tax time. Collaborating with a knowledgeable tax consultant helps identify and claim these credits effectively.

Understanding Tax Deadlines

Understanding tax deadlines is crucial for small business owners to maintain compliance with tax laws and avoid costly penalties. Many common mistakes arise from missing key filing dates and failing to plan for tax payments effectively.

Missing Key Filing Dates

Failing to meet filing deadlines can result in penalties and interest. Small businesses often overlook state tax filings, especially if they have remote employees. Ensure you file state taxes where employees live and where your business holds tax obligations. Additionally, several key tax forms, such as the 1040 series for income tax and the 941 for payroll tax, have specific due dates. Missing quarterly estimated taxes can contribute to tax liabilities, triggering penalties. Set reminders for these dates to avoid issues. Utilize tax software or a tax consultant to help manage these critical filing requirements accurately.

Poor Tax Payment Planning

Inadequate planning for tax payments can lead to significant financial stress. Many small businesses find themselves in a cash flow crunch and neglect local, state, or federal tax obligations. Prioritize tax payments over discretionary expenses to reduce the risk of penalties and audits. Maintaining a separate business bank account helps track business expenses and income accurately, making expense tracking easier. Consider employing effective tax planning strategies, such as setting aside funds regularly to cover your tax liabilities. Using bookkeeping software can streamline recordkeeping and ensure your tax documentation is thorough. With proactive tax planning, you equalize tax liabilities and optimize potential tax deductions and credits.

Seeking Professional Help

Navigating small business taxes can be complex. Engaging a tax professional simplifies this process, ensuring compliance with tax laws and maximizing potential savings.

When to Hire a Tax Professional

- You should hire a tax professional if you’re unsure about classifying employees versus independent contractors, as misclassification can lead to back taxes and penalties.

- If your business involves complex financial transactions, such as managing multiple state taxes or significant start-up costs, a tax consultant ensures accurate reporting and optimal tax deductions.

- For businesses with poor financial organization or record-keeping challenges, a tax accountant helps implement efficient bookkeeping practices that comply with IRS standards.

Benefits of Tax Preparation Services

- Tax preparation services help maintain accurate record-keeping, minimizing the risk of missed deductions and reducing the chance of IRS scrutiny. Recommended tools include bookkeeping software like QuickBooks or Xero.

- Engaging tax professionals ensures compliance with federal and state tax laws, including estimated tax payments and payroll tax deposits, preventing costly penalties for late filings.

- Professionals identify tax deductions and credits commonly overlooked, allowing your business to maximize tax savings. This includes properly deducting start-up costs and other eligible business expenses.

- A tax consultant aids in separating business and personal finances, a common mistake that complicates tax reporting. They recommend opening dedicated business accounts.

- Tax professionals streamline the tax preparation process, reducing stress and saving time during tax season. This allows you to concentrate on running your business effectively.

By collaborating with tax experts and utilizing tax preparation services, you benefit from streamlined processes, accurate reporting, and optimized tax strategies.

Conclusion

Avoiding tax mistakes is crucial for the success of your small business. By staying informed about common pitfalls and implementing proactive strategies you can protect your finances and ensure compliance.

Utilizing bookkeeping tools maintaining accurate records and understanding tax classifications will help you navigate the complexities of tax regulations. Don’t overlook valuable deductions and credits that can significantly reduce your tax liability.

Establishing a solid tax planning strategy and seeking professional guidance when needed can streamline your tax process. With the right approach you can focus more on growing your business while minimizing stress related to tax obligations.

Frequently Asked Questions

What are common tax pitfalls small business owners face?

Small business owners often misclassify employees, fail to claim deductions, and neglect accurate record-keeping, which can lead to costly mistakes and audits. Understanding these pitfalls is essential for tax compliance and financial stability.

Why is accurate record-keeping important for taxes?

Accurate record-keeping helps small business owners track income and expenses effectively, ensuring they don’t miss deductions and are prepared for potential audits. It simplifies the tax filing process and aids compliance with tax regulations.

How can business owners avoid missing deductions?

Business owners can avoid missing deductions by maintaining thorough documentation of business expenses, staying informed about available tax credits, and regularly reviewing their potential deductions with the help of a tax professional.

What is the home office deduction, and how can I qualify?

The home office deduction allows business owners to deduct a portion of their home expenses when operating a business from home. To qualify, they must measure their workspace and keep detailed records of associated expenses.

Why do I need to understand tax deadlines?

Understanding tax deadlines is crucial to avoid penalties and maintain compliance. Missing filing dates, such as state and federal deadlines, can lead to financial repercussions and stress for business owners.

How can I manage tax payments effectively?

To manage tax payments effectively, prioritize tax obligations over discretionary expenses, maintain a separate business bank account, and regularly set aside funds for tax liabilities to minimize financial strain.

When should I consider hiring a tax professional?

Consider hiring a tax professional if you are uncertain about employee classifications, dealing with complex transactions, or struggling with financial organization. They can help ensure compliance and maximize savings on your taxes.

What role do tax preparation services play for small businesses?

Tax preparation services assist small businesses by maintaining accurate records, minimizing missed deductions, and ensuring compliance with tax laws. They help reduce stress during tax season and allow owners to focus on their business.

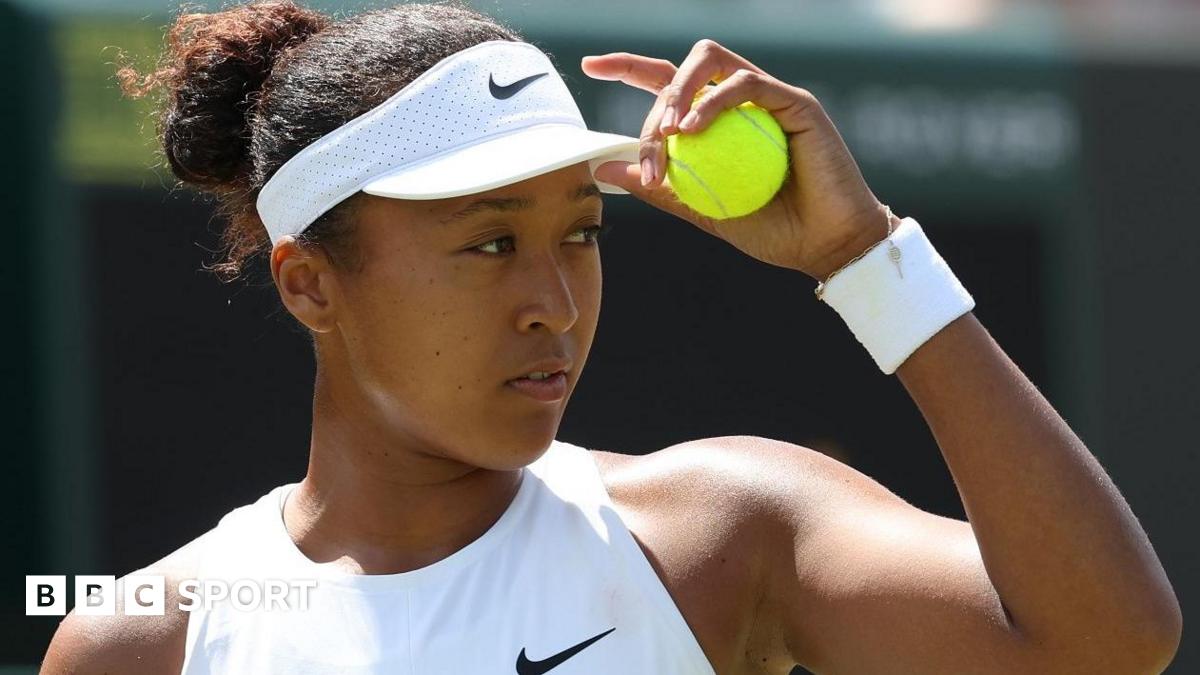

Image Via Envato

This article, "Avoiding Small Business Tax Mistakes: Essential Tips for Success" was first published on Small Business Trends

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

.jpg?width=1200&auto=webp&trim=0,0,0,0#)