Bridging the LGBTQ+ wealth gap

In many ways, the world is a much friendlier place for members of the LGBTQ+ community on this, the 56th anniversary of the Stonewall uprising, than it was a lifetime ago.

But that doesn’t make navigating American life while queer any less frightening. In addition to the federal government making overt attacks on LGBTQ+ rights, many of the same invisible barriers that kept the LGBTQ+ community impoverished a lifetime ago are still at work today.

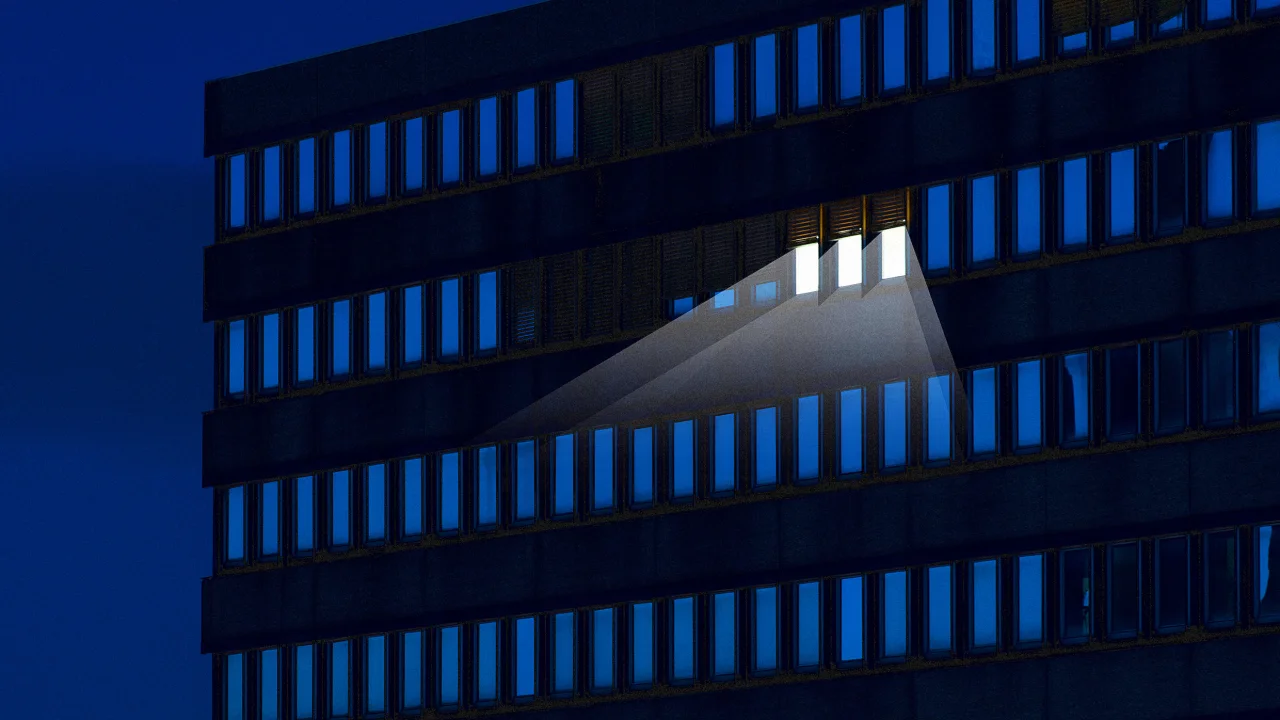

Financial marginalization may seem like small potatoes compared to fighting for the right to exist, but the unacknowledged systems keeping the LGTBQ+ wealth gap in place are the same systems working to erase queer history.

Illuminating these hidden financial systems is the first step toward bridging the wealth gap.

The problem: family estrangement

Gay and lesbian young adults are 86% more likely to report estrangement from their fathers than their straight counterparts, according to a 2022 National Institute of Health study, and a recent U.K. survey found that 46% of LGBTQ respondents between the ages of 18 and 25 are estranged from at least one family member.

Estrangement is painful enough, but it can also put queer kids at serious financial risk. LGBTQ+ youth have a 120% higher risk of experiencing homelessness compared to the general population.

But even if coming out doesn’t completely sever the familial relationship, it can change family dynamics, including financial expectations. In the 2023 LGBTQI+ Economic and Financial (LEAF) Survey, 38% of those surveyed said they lost the option of relying financially on their families after coming out. This leads to things like a significantly higher likelihood of carrying student debt into adulthood and more than double the rate of bank overdrafts compared to the general population.

The early loss of direct financial assistance may be the most obvious obstacle to LGBTQ+ wealth building, but Dr. Jenna Brownfield, a queer Licensed Psychologist based in Minnesota, suggests looking at the less clear-cut financial barriers that come with estrangement.

“It’s more than just passing down wealth,” Dr. Brownfield says. “It’s also the knowledge of how to navigate finances. If you don’t have a relationship with an older family member to demystify and guide you through things like insurance and taxes, you’re left to learn that on your own.”

Unlike learning how to change a tire, roast a chicken, or apply a perfect smoky eye-shadow effect, it can be more difficult to find reputable and trustworthy financial information on YouTube or TikTok—and the lack of this knowledge really hurts anyone who falls afoul of Lady Luck or Uncle Sam.

The work-around: chosen family

Parents have been cutting off their LGBTQ+ kids from time immemorial, and the queer community has responded by creating a culture of chosen family. Leaning into the cultural legacy of multigenerational queer friendship and found family is an excellent way to help bridge the financial knowledge gap.

Though discussing money is typically a taboo topic for discussion, openly sharing hard-won money skills with the younger generation is an excellent way to fight back against marginalization.

The problem: lack of access to healthcare

Approximately 17% of LGBTQ+ adults do not have any health insurance, which is a major improvement over the 34% of queer adults who were uninsured in 2013, just before the implementation of the Affordable Care Act. But having insurance doesn’t necessarily equate to receiving care.

A recent Kaiser Family Foundation survey found that LGBTQ+ adults faced higher rates of discrimination and unfair treatment at the doctor’s office compared to non-LGBTQ adults. Queer adults were also more likely to report going without needed mental health care because of affordability or accessibility.

But even finding a caring doctor in network doesn’t guarantee affordable healthcare, especially for transgender individuals: 82% of LEAF survey respondents who received gender-affirming care reported spending some money out of pocket. Nearly half (46%) of those respondents spent $5,000 or more, while 33% spent at least $10,000 of their own money.

But whether it’s paying out of pocket for affirming care or avoiding the doctor because of cost (or bad experiences) until the only choice is the emergency room, cutting the LGBTQ+ community out of healthcare becomes another invisible financial drain.

The work-around: medical allyship

The American system of health insurance doesn’t really work for anyone, but it seems to make a special effort to work especially badly for marginalized groups like the LGBTQ+ community. While there is very little that cishet friends of queer folks can do about the obscenely high insurance copays and deductibles, a friend can potentially ride along to doctor’s visits.

There are two good reasons for roping a friend into a doctor’s appointment. First, since LGBTQ+ folks are more likely to face discrimination and unfair treatment in healthcare settings compared to straight patients, the presence of a friendly ally may mitigate any awful behavior on the part of the medical team.

Second, making doctor visits an outing with a friend increases the likelihood of actually going and getting necessary preventive care. That will lead to better health and financial outcomes.

Dr. Brownfield has also seen other ways that cishet allies have stepped up to help with the high cost of LGBTQ+ healthcare.

“Prescription hormone replacement therapy (HRT) to help with perimenopausal symptoms would be covered differently by my insurance than they would for a trans woman getting the same exact prescription,” she says. “As legislation changes, I’m seeing work-arounds where cis women or cis men are securing an HRT prescription and providing it to their trans loved ones or trans folks in their community.”

Unfortunately, this kind of workaround means the patient doesn’t have a medical professional to collaborate with for proper dosage. Dr. Brownfield emphasizes that prescription swapping is the direct and hazardous result of legislating care. “When gender-affirming care becomes illegal, its use doesn’t go down–but its safe use does,” she says.

The problem: mortgage discrimination

As of 2019, a study published in the Proceedings of the National Academy of Sciences found that same-sex couples were 73% more likely to be denied a mortgage than heterosexual couples.

There has not been a follow up to this study in the past six years, but homeownership among the LGBTQ+ community remains lower than it is among straight, cisgender adults: 49% of queer adults own a home, compared to 64% of the U.S. population as a whole.

Getting shut out of home ownership is a great way to cut LGBTQ+ wealth building off at the knees. A primary residence is a typical U.S. homeowner’s most valuable asset, accounting for about 45% of their household net worth, on average.

The work-around: shared housing

“Informal shared housing is something that’s happened in the queer community for decades,” Dr. Brownfield says. “Especially for youth and young adults. There’s often like a house mother and everyone shares resources and responsibilities, but it’s all done informally.”

While this kind of setup probably won’t land a sweet, low-cost mortgage loan—it’s unlikely the shared housing is anything other than a rental—it can be an inexpensive way to live with friends while saving money toward home ownership or other goals.

Making the invisible visible

Neither the financial obstacles facing the LGBTQ+ community nor the creative work-arounds to overcome those barriers are news to queer folks. But for those of us who might put away our allyship when retailers set out the next seasonal display, it’s important to remember that systemic issues occur year-round, and not just while the rainbow flags are flying.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0