Nation’s top supplier: Housing market pain worse than builders say

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Builders FirstSource, the largest U.S. supplier of building materials and prefabricated components, is valued at $14 billion. Given that it takes orders and makes deliveries to builders across the nation, few firms have a more comprehensive view of both multifamily and single-family construction.

That’s why it’s notable that Builders FirstSource CEO Peter Jackson went out of his way on Thursday to suggest to Wall Street analysts that commentary coming from giant publicly traded homebuilders this earnings season was underplaying softening and softness in residential construction.

“There were a lot of public homebuilders that have released [earnings] over the past couple of weeks [that reported relatively more positive pictures], versus kind of our signal here that it’s a bit worse than what people are thinking,” Jackson told analysts on the company’s July 31 earnings call.

Jackson added: “Given the inventory environment and what we’re seeing in terms of the land market, what we’re hearing about the takedowns and the contracts, our sense is builders are slowing on the start side . . . Our sense is that slowing, that resetting to a lower [housing starts] rate in order to manage those completed home inventory levels, that’s what’s going to flow through. So that’s the slowing indication that you’ve got from us.”

This weaker housing demand environment is causing unsold completed inventory—in particular, in the Sun Belt—to tick up.

Indeed, since the Pandemic Housing Boom fizzled out, the number of unsold, completed U.S. new single-family homes has been rising:

- June 2018 —> 62,000

- June 2019 —> 79,000

- June 2020 —> 66,000

- June 2021 —> 34,000

- June 2022 —> 38,000

- June 2023 —> 69,000

- June 2024 —> 99,000

- June 2025 —> 119,000

The June figure (119,000 unsold, completed new homes) published this week is the highest level since July 2009 (126,000).

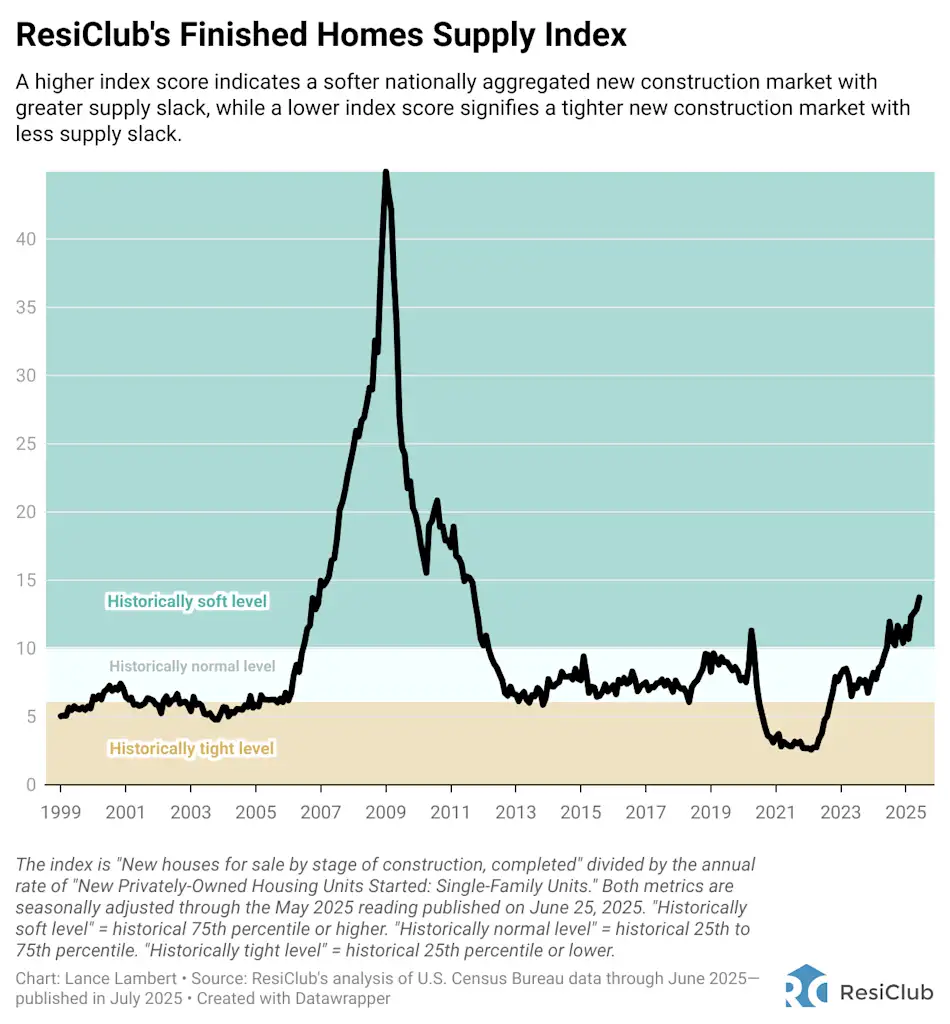

To put the number of unsold, completed new single-family homes into historic context, we have ResiClub’s Finished Homes Supply Index (see chart above). The index is one simple calculation: the number of unsold, completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts.

A higher index score indicates a softer national new construction market with greater supply slack, while a lower index score signifies a tighter new construction market with less supply slack. If you look at unsold, completed single-family new builds as a share of single-family housing starts (see chart below), it still shows we’ve gained slack / single-family construction demand is softening. However, it puts us closer to pre-pandemic 2019 levels than the Great Financial Crisis bust. That said, if new construction or the economy hit a big speed bump and housing starts dropped by 20% to 30%, this ratio would spike quickly—even if unsold builds didn’t increase much.

Much of the completed unsold single-family new builds is located in pockets of the Sun Belt—in states like Florida, Texas, Arizona, Colorado, and Tennessee.

According to ResiClub’s statistical analysis, there is a modest to moderate correlation between recent single-family permitting levels and active inventory rising above pre-pandemic 2019 levels.

In other words, many of the places where single-family homebuilders have the strongest presence are also the housing markets that have experienced the greatest recent softening. If you talk to homebuilders in Cleveland, Boston, or New Haven, you’re likely to hear a very different story right now than from their peers in Tampa, Austin, and San Antonio.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

![Foundry Town Survivors chart a cinematic storm with haunting sea ballad 'Three Sisters' [Video]](https://earmilk.com/wp-content/uploads/2025/08/A-5-800x825.jpg)