The real reason a staggering 40% of U.S. homeowners are mortgage-free

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

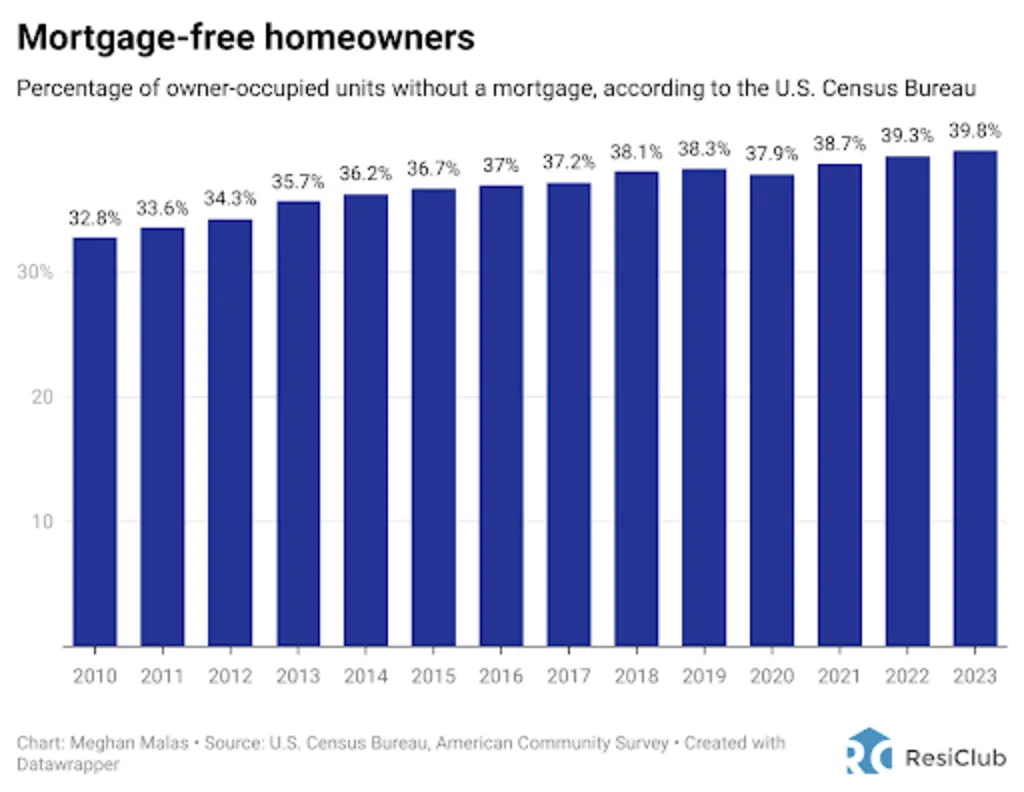

Here’s a stat that would likely make financial advisor and radio personality Dave Ramsey—who has long advocated for Americans to pay off their mortgages early as a key pillar of his debt-free philosophy—at least somewhat pleased: A staggering 39.8% of U.S. owner-occupied housing units in 2023 were mortgage-free, marking a new high for this data series. That’s up from 39.3% in 2022 and 32.8% in 2010.

Among the 85.7 million U.S. homeowner occupied households, 34.1 million are mortgage-free. The other 51.6 million have an outstanding mortgage.

So why did I say it’d only make Dave Ramsey “somewhat pleased”?

Well, the reason is that a higher percentage of Americans are mortgage-free isn’t necessarily because so many are paying off their mortgages faster. Instead, it reflects a powerful underlying demographic shift: the aging composition of the American population.

As Americans live longer, the U.S. fertility rate declines, and the massive baby boomer generation ages into their senior years, the U.S. population has skewed older. Since older homeowners are more likely to have paid off their mortgages, the aging composition of the American population means a larger share of homeowners are achieving mortgage-free status each year.

The other thing is that when older Americans sell their house and buy another home, they’re more likely to rollover their equity and purchase that next home in all-cash.

Given that most demographic forecasts expect the composition of the American population to continue shifting upward in age, the share of mortgage-free households could also continue rising in the years to come. The wild card? If reverse mortgages get more popular and more older Americans take on mortgage debt again to tap into their equity.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0