Hidden shock ahead for the housing market: Immigration boom-bust

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

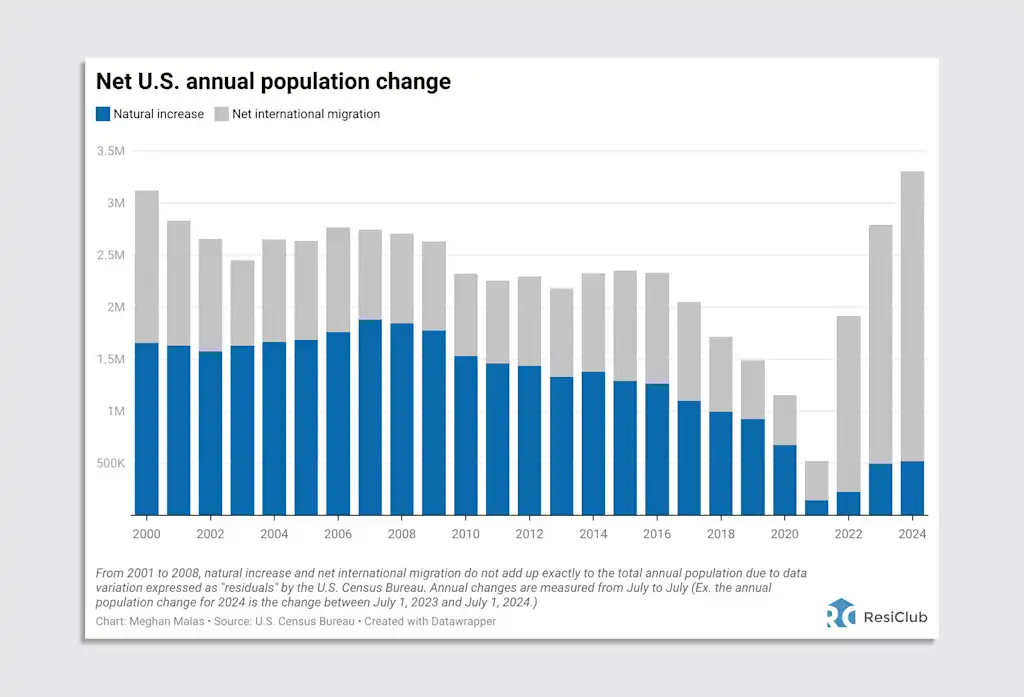

Between summer 2021 and summer 2024, the U.S. saw a substantial upswing in net international migration—much of it coming through the southern border. As of July 2024, the U.S. population stood at 340.1 million, up 3.3 million from 336.8 million in July 2023. Of that population increase, 2.8 million (or 85%) came from net international migration.

That international migration burst, of course, is behind us now. Recently, border crossings have plummeted.

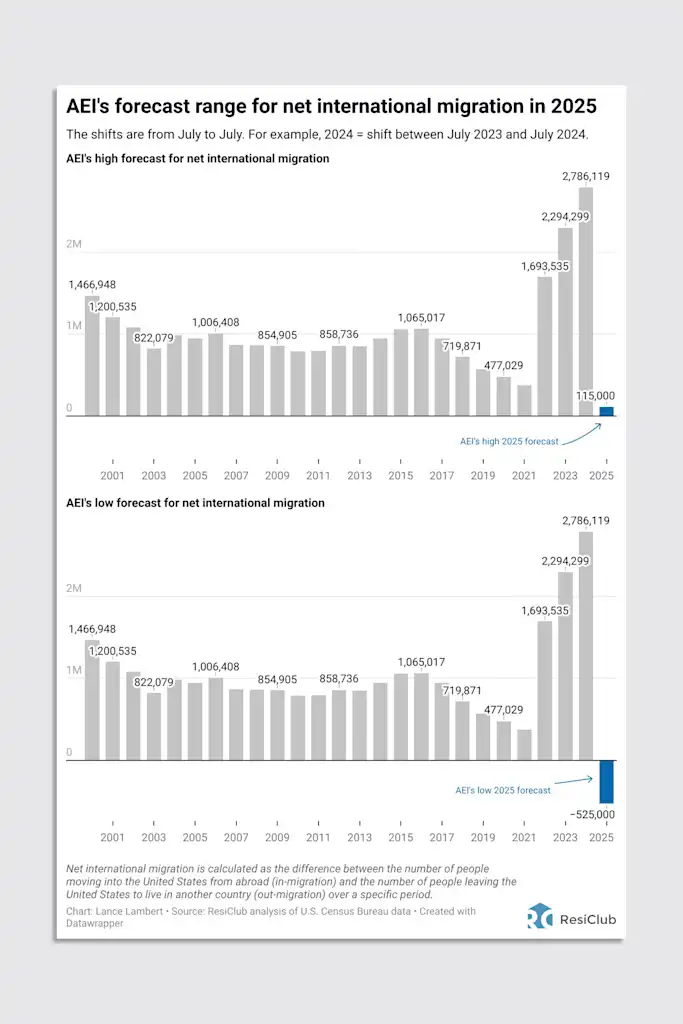

The updated forecast by researchers at AEI expects that net international migration in 2025 will be somewhere between +115,000 and -525,000.

“We assess the macroeconomic implications of the observed and expected changes to immigration policy during the second Trump administration,” wrote AEI researchers in July. “We project that net migration in 2025 will be between −525,000 and 115,000, reflecting a dramatic decrease in inflows and somewhat higher outflows. Net migration may be reduced even further in 2026 before rebounding in 2027 and 2028.”

Below is a ResiClub chart that shows just how large a share of overall population growth comes from international migration.

What does this international migration slump mean for the U.S. housing market?

All else being equal, in my view, an immediate and direct housing impact of fewer immigrants coming through the southern border is lower aggregate rental demand—specifically, at the lower end of the market—than if that burst had continued.

Rental markets likely to see the biggest impact are in metro areas that have experienced the most international immigration in recent years. In particular, major markets such as New York City, Miami, and Houston could feel the greatest effects.

Many economists, including those at the AEI Housing Center, believe this pullback in international migration could dampen U.S. total employment growth and reduce overall U.S. economic activity.

Heading into 2025, many analysts speculated that a sharp pullback in immigration through the southern border would quickly put upward pressure on builders’ labor costs. However, so far, dampened residential construction activity has more than outweighed any of those pressures.

“Labor also seems to be more available in our markets, potentially stemming from slower multifamily construction and reduced starts in the industry,” Hilla Sferruzza, CFO of Meritage Homes, said during the builder’s July 24 earnings call.

America’s largest homebuilder, D.R. Horton, shared a similar take with analysts.

“From labor availability, it’s plentiful,” D.R. Horton CEO Paul Romanowski said during the company’s earnings call on July 22. “We have the labor that we need. Our trades are looking for work. And that’s why you’ve seen sequential and year-over-year reduction in our cycle time. Because we have the support we need to get our homes built. And, you know, given those efficiencies, reductions in stick and brick [costs] over time. Some of that is from design. And efficiency of the product that we’re putting in the field. And some of that is just from the efficiency of our operations.”

One other thing analysts should keep in mind is that international immigration, in particular, through the southern border, greatly exceeded pre-pandemic norms between summer 2021 and summer 2024. Even if net immigration were to go flat or slightly negative, it’d still take awhile to offset / smooth over the recent surge.

That pull-forward in international immigration, coupled with currently softening aggregate residential construction activity, is another reason why the recent sharp pullback in international immigration might take longer than some anticipated to tighten the residential construction labor market. We’ll continue to keep an eye on it.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0