The healthcare crisis none of us can afford

Millions of individuals and families across the U.S. are trapped in a vicious cycle. Financial concerns like inflation and housing costs are harming their mental health, and the rising cost of healthcare—another major concern for households—is preventing them from getting the care they need. That makes all of their health problems worse, and the cycle keeps spinning faster and faster.

That was the key insight from our recent survey on mental and financial health we conducted with Talker Research. About 70% of U.S. adults said their financial anxiety is at an all-time high, and 20% reported a decline in their mental health over the past year.

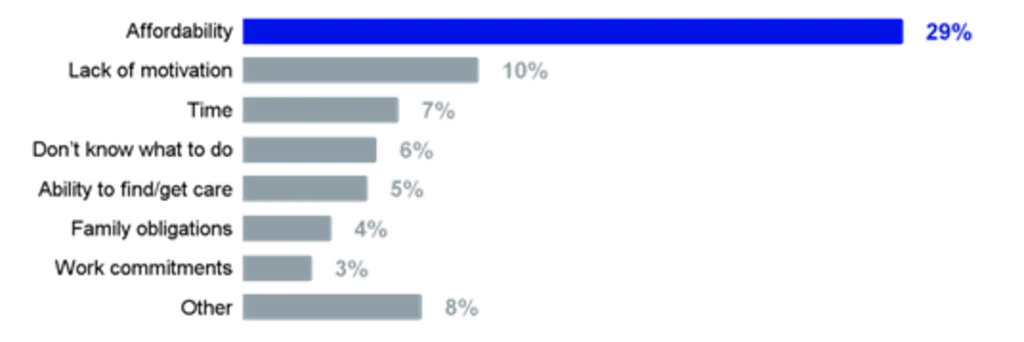

If that weren’t alarming enough, roughly 30% of people said their mental health had been negatively impacted by the cost of healthcare, or by the difficulty of accessing healthcare for themselves or a loved one. Most discouraging, despite the evident need, only 14% of people were currently seeing a therapist or psychiatrist. The top reason people cited for not getting help? Affordability, by a wide margin.

Mental health access barriers

What is the biggest challenge preventing you from seeking professional care for mental health?

Costs are rising

This tangle of financial anxiety, cost-related access barriers and deteriorating mental health are a crisis in the making for all of us. When people forgo needed care or medications due to cost—as 36% of Americans recently have—their physical and mental health problems tend to get worse, which makes them more likely to end up in the emergency room or a hospital bed.

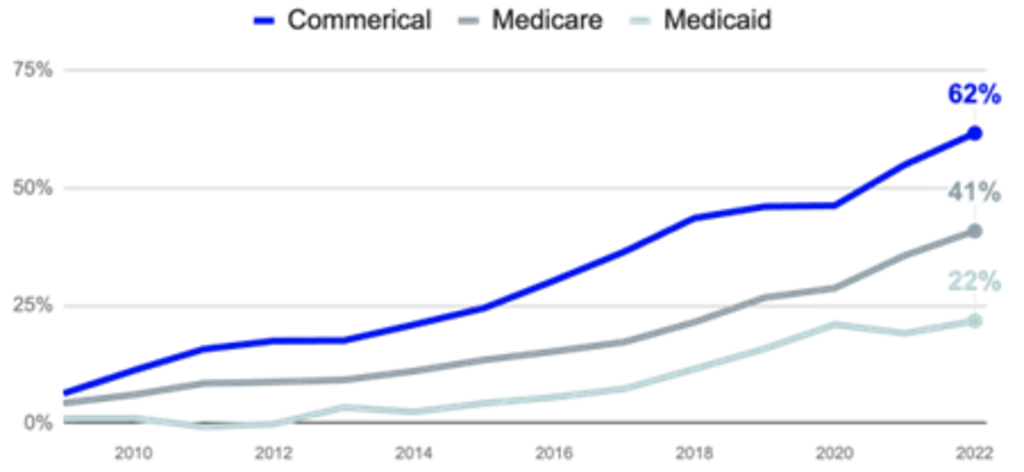

This cycle is an especially acute problem in the commercial insurance market, which largely comprises employers providing health benefits to America’s workforce (158 million people). Thanks in part to surging hospital prices, per-capita healthcare spending has shot up faster in the commercial market than in Medicare or Medicaid—and the cost trend is only getting steeper.

Cumulative growth in per capita spending by insurance type since 2008

Employee benefits

Rising costs are trickling down to individuals and families through higher premiums and copays, even though employers, to their credit, have absorbed most of the increases in recent years. In fact, in an effort to support their workforce and rein in costs, many employers have upped their investment in a wide range of health benefits—often at little or no cost to employees—to close gaps in care and guide their people toward high-quality, cost-effective support. These benefits range from mental health apps, platforms for telehealth and chronic condition management, navigation services, and much, much more.

While some of these offerings do help individuals get healthier and generate cost savings, it’s clear they haven’t done enough to reverse the broader affordability trend. How come?

Engagement is one problem. Too few employees are aware of their benefits, enroll in them, or stick with them long enough to impact their health or financial outcomes. Employee engagement is always an uphill battle, and the lack of integration in healthcare only makes it harder. Mental, physical, and financial health can’t be addressed in isolation, as the recent survey findings show. But most tools and services aren’t connected, making it nearly impossible for individuals to experience a seamless journey that supports all of their healthcare needs.

A bigger, related problem is the fee-for-service payment model. Engagement alone—getting people to use more services—won’t improve outcomes if the care isn’t timely or high quality. In the commercial market, a shift toward value-based care and contracting is helping employers, employees, and healthcare partners align incentives to drive better clinical and financial results for everyone.

What people really need, what they’re missing most, is personalized, all-in-one healthcare that provides integrated medical and mental health support, care coordination, benefits guidance, and help with billing and claims, all of it connected by empathetic humans who are looking out for the whole person. Mind, body, wallet. Taking care of any one of these dimensions of health—and bringing down costs for everyone—requires taking care of all three.

Owen Tripp is cofounder and CEO of Included Health.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0