Nvidia and AMD cut a chip revenue-sharing deal with Trump. Here’s how their stock prices are reacting

In a historically unusual move, two of the world’s largest chipmakers, Nvidia and AMD, have reportedly cut a deal with the Trump administration to hand over 15% of their revenues from certain chip sales to the U.S. government. Here’s what to know about the deal and how Nvidia’s and AMD’s stock prices are reacting.

What’s happened?

Yesterday, the Financial Times reported that chipmaking giants Nvidia and Advanced Micro Devices (AMD) have struck a highly unusual deal with the U.S. government. According to the FT, the deal will see Nvidia and AMD give up 15% of revenues from chip sales of two specific chips to China, the H20 chipset by Nvidia and the MI308 chipset by AMD.

In return for the 15% revenue-sharing agreement, the U.S. government has approved export licenses for those chips to China. Without export licenses, which the U.S. had previously failed to grant the companies, Nvidia and AMD could not legally export their chips to the country.

The FT cited “people familiar with the situation, including a US official” as the sources of the information.

“We follow rules the U.S. government sets for our participation in worldwide markets,” a Nvidia spokesperson told Fast Company when reached for comment. “While we haven’t shipped H20 to China for months, we hope export control rules will let America compete in China and worldwide. America cannot repeat 5G and lose telecommunication leadership.”

Fast Company has also reached out to AMD and the Commerce Department.

The revenue-sharing agreement is an unusual one, as no other companies before now have ever agreed to share a portion of their revenue with the U.S. government in exchange for export licenses. The Trump administration has reportedly also not decided what the U.S. government will do with the proceeds it reaps from Nvidia and AMD’s chip sales to China.

A spokesperson for Nvidia did not deny the deal, with the company telling the FT, “We follow rules the US government sets for our participation in worldwide markets.”

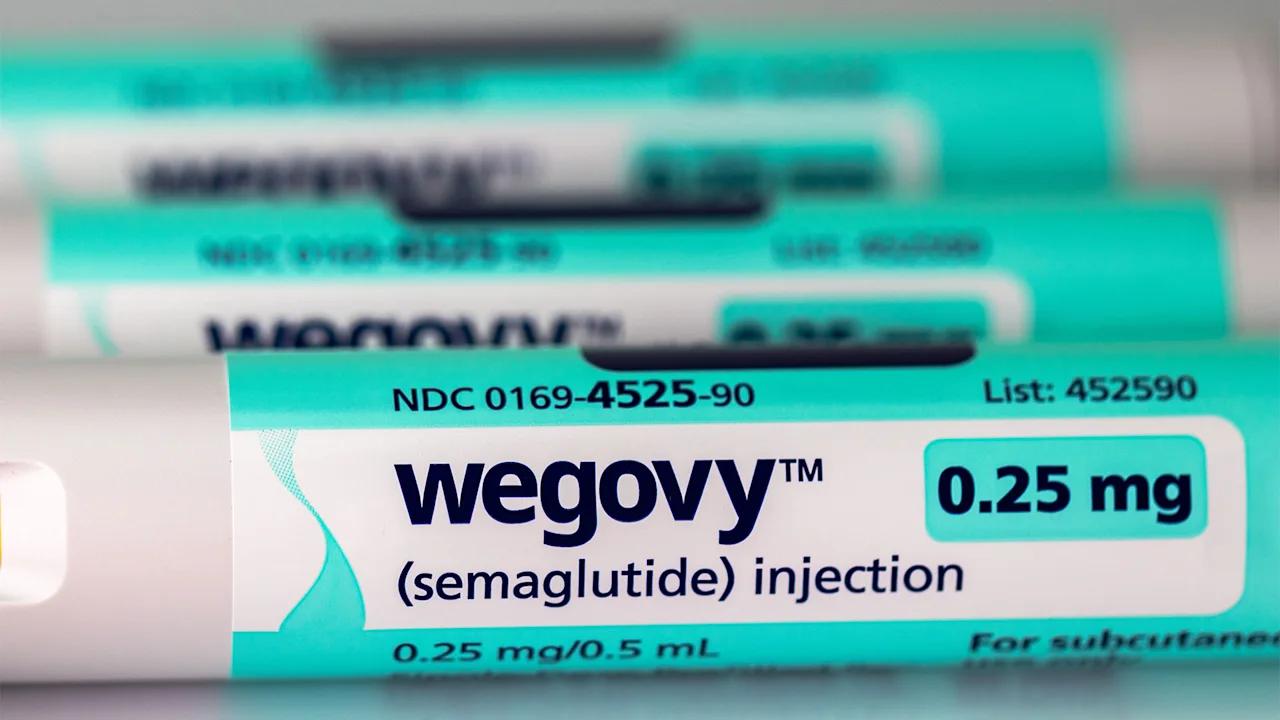

What are the H20 and MI308 chips?

Before the two chip giants made a revenue-sharing deal with the Trump administration, the H20 and MI308 chipsets had been waiting for months for export license approvals.

The H20 chip by Nvidia and the MI308 chip by AMD were designed by the companies for the Chinese marketplace specifically, and within the constraints that the Biden administration had placed on exporting U.S. chips to China. But when Trump came into office earlier this year, his administration placed export controls on those chips over national security fears.

Nvidia has previously disputed that its H20 chips could give Chinese industry a leg up in the AI race.

Now, however, any supposed national security concerns are taking a back seat to profits, as the export licenses have now been granted after the revenue-sharing deal was agreed.

That revenue-sharing agreement stands to see the U.S. government rake in billions as the chipmakers now have the go-ahead to sell to China. According to the FT, one estimate noted that Nvidia could sell as much as $23 billion worth of its H20 chips to China in 2025 alone.

How are Nvidia and AMD stock reacting?

Obtaining export licenses for chips is usually considered a good thing by investors in any chipmaking company.

However, after the FT broke the news of the revenue sharing deal, shares of both Nvidia Corporation (Nasdaq: NVDA) and Advanced Micro Devices (Nasdaq: AMD) are down in premarket trading as of the time of this writing.

NVDA shares are currently down about 0.71% and AMD shares are currently down about 1.6%. While these share price drops aren’t that large, any decline in a chipmaker’s stock price after winning an expert license is pretty rare.

This could suggest that investors are concerned that companies are ceding too much revenue to the U.S. government in exchange for expert licenses, potentially harming their bottom lines.

But just as likely is that investors aren’t entirely sure how to digest the news. The deal potentially sets a new precedent where companies that need export licenses now may need to start sharing their revenue directly with the U.S. government. Such a system is unheard of in free-market democracies.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0